Most people think wealth comes from saving money or getting a raise. But if you look at the people who’ve truly built long-term financial freedom, you’ll find one common thread: they traded stocks. Not gambling on meme stocks. Not chasing hot tips. But buying businesses, holding them through downturns, and letting time do the heavy lifting.

Stock Trading Isn’t Just for Day Traders

The word "trading" makes people think of screens flashing green and red, traders yelling on floors, or TikTok influencers promising 10x returns in a week. That’s not what builds wealth. Real wealth from stocks comes from ownership - owning pieces of companies that grow over time. When you buy a share of Apple, you’re not betting on the price going up tomorrow. You’re buying a small slice of a company that made $110 billion in profit last year. That’s the difference.

From 1990 to 2025, the S&P 500 returned an average of 10.2% per year, even after crashes, recessions, and pandemics. That’s not magic. That’s compounding. $10,000 invested in 1990 would be worth over $250,000 today. Not because someone timed the market perfectly. But because they stayed in.

How Stock Trading Turns Small Amounts Into Real Wealth

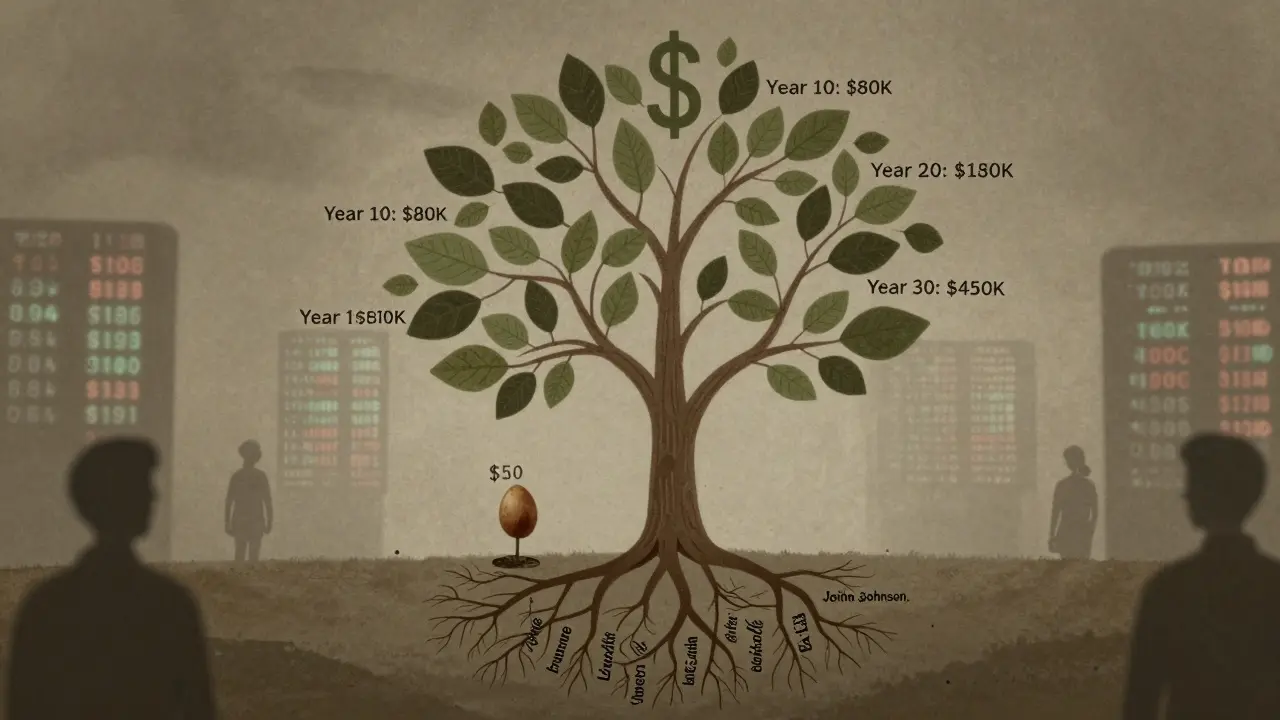

You don’t need $100,000 to start. You need consistency. Let’s say you invest $300 a month - that’s less than your phone bill. At 8% annual growth (a conservative average), after 20 years, you’ll have about $180,000. After 30 years? Over $450,000. That’s not fantasy. That’s math.

Here’s what most people miss: the real power isn’t in picking the best stock. It’s in staying invested. People who sold during the 2008 crash or in March 2020 missed the biggest rallies in history. The market doesn’t reward timing. It rewards presence.

The Hidden Rules of Wealth-Building Stock Trading

There are three rules most successful traders follow - not because they’re geniuses, but because they learned the hard way.

- Focus on quality, not hype. Companies with strong balance sheets, consistent profits, and growing customer bases - like Johnson & Johnson, Coca-Cola, or Microsoft - have outperformed flashy startups for decades.

- Reinvest dividends. Dividends are cash payments from companies to shareholders. Reinvesting them buys more shares, which earn more dividends. Over time, this turns a small income stream into a snowball. For example, if you bought $10,000 worth of Procter & Gamble stock in 1990 and reinvested every dividend, you’d now own over 1,200 shares worth more than $150,000.

- Ignore the noise. News cycles move prices short-term. But businesses move them long-term. If a company’s earnings are growing and its product still matters, a bad quarter or a political headline won’t change its value over 10 years.

Why Most People Fail at Stock Trading for Wealth

It’s not the market that’s rigged. It’s the mindset.

People trade because they’re scared of missing out. Or they’re angry they lost money last year. Or they think they can outsmart Wall Street with a chart and a gut feeling. The data doesn’t lie: 80% of individual traders lose money over five years. Why? They treat stocks like lottery tickets.

Real wealth builders don’t trade daily. They track quarterly earnings. They check their portfolio once a month. They sleep well because they know what they own - and why they own it.

One client I know (a nurse in Milwaukee) started with $50 a month in 2015. She bought low-cost index funds and a few blue-chip stocks. She never touched it. In 2024, she sold a portion to buy her first home. She still holds the rest. She didn’t become rich overnight. She became rich by refusing to quit.

Stock Trading vs. Other Ways to Build Wealth

Let’s compare stock trading to other common paths:

| Method | Typical Return (Annual) | Time to Build $250K | Risk Level |

|---|---|---|---|

| Stock Trading (S&P 500) | 8-10% | 18-22 years | Medium |

| Real Estate (Rental) | 6-9% | 20-25 years | High |

| Savings Account | 0.5-1% | Over 100 years | Low |

| Starting a Business | Varies widely | 10-15 years (if successful) | Very High |

| Crypto Speculation | Highly volatile | Unpredictable | Extreme |

Stock trading wins because it’s accessible, liquid, and historically reliable. You don’t need a down payment. You don’t need to fix up a property. You don’t need to manage tenants. You just need to start small and stay steady.

Getting Started Without Overwhelm

If you’re new, here’s a simple path:

- Open a brokerage account (Fidelity, Charles Schwab, or Robinhood - all have $0 fees).

- Set up automatic transfers: $50, $100, or whatever you can afford.

- Buy an S&P 500 index fund (like VOO or SPY). It holds 500 of the biggest U.S. companies.

- Wait. Don’t check it daily. Don’t panic when it drops.

- After 6 months, add one or two dividend-paying stocks you understand - like Walmart or Coca-Cola.

You don’t need to learn everything at once. You just need to begin.

What Happens When You Stop Trading Like a Gambler

When you stop trying to beat the market and start owning part of it, something shifts. You stop watching the ticker. You start reading annual reports. You care about management quality, not stock charts. You begin to think like an owner, not a speculator.

That’s when wealth stops being a dream and becomes a habit. You don’t need to be rich to start. You just need to be patient. And consistent.

The market doesn’t reward the loudest. It rewards the longest.

Can you really get rich from stock trading?

Yes - but not by day trading or chasing trends. Real wealth comes from owning quality businesses over decades. People who invested $200 a month in the S&P 500 since 2000 have over $170,000 today. It’s not luck. It’s compound growth.

How much money do I need to start stock trading for wealth?

You can start with as little as $50. Many brokers let you buy fractional shares, so you can own a piece of Amazon or Tesla without buying a full share. The key isn’t how much you start with - it’s how consistently you add to it.

Is stock trading better than saving money in a bank?

Yes, for long-term wealth. Bank savings accounts earn less than 1% interest. After inflation, you’re losing purchasing power. The stock market has returned about 10% annually over the last 100 years. That’s the difference between staying even and building real wealth.

Should I trade individual stocks or index funds?

Start with index funds. They spread your risk across hundreds of companies. Once you understand how markets work, you can add a few individual stocks you’ve researched. But don’t try to pick winners early. Most people lose money trying.

What’s the biggest mistake new traders make?

They treat the market like a casino. They buy based on news, trends, or tips. They sell when prices drop. The best traders do the opposite: they buy when others are scared and hold through volatility. Emotions destroy wealth. Discipline builds it.

How often should I check my portfolio?

Once a month is enough. Checking daily makes you anxious. Focus on adding money regularly and holding quality assets. The market will move up and down - that’s normal. Your job is to stay in the game.

Final Thought: Wealth Is a Byproduct of Patience

You don’t need to be a financial expert to build wealth through stock trading. You just need to start. You just need to keep going. And you need to believe that time is your strongest ally.

The richest people in the world didn’t get there by flipping stocks. They got there by owning them - for decades.

Nathaniel Petrovick

January 15, 2026 AT 23:52I started with $100 a month in 2018 and just hit $80k in my brokerage account. Not because I'm smart, but because I stopped checking it every day. The market doesn't care if you're nervous, it just keeps compounding.

Trust the process. It's boring, but it works.

Honey Jonson

January 16, 2026 AT 02:49omg yes!!! i started with 50 bucks a month after my friend showed me how to use robinhood and now i have like 120k?? no joke

just buy the index and forget about it

also dividends are magic like literally free money that grows itself

Sally McElroy

January 17, 2026 AT 06:57It's not that stock trading builds wealth-it's that the system is rigged to reward those who have capital to begin with. The idea that $50 a month is enough is a dangerous myth. Inflation eats that. Taxes eat that. And let's not pretend that index funds are somehow neutral. They're still tied to corporate greed, shareholder capitalism, and the exploitation of labor.

Real wealth is community ownership, not passive ownership of a S&P 500 basket.

And yes, I'm aware this makes me unpopular here.

Cynthia Lamont

January 17, 2026 AT 15:18Stop. Just stop. You say 'conservative average' of 8%? That's not conservative-that's fantasy. The S&P 500 hasn't returned 8% annually after inflation since 2008. You're cherry-picking 1990-2025 to make it look easy. What about 2000-2010? Lost decade. What about 2022? Down 19%.

And 'dividends reinvested'-sure, if you're in the US and don't pay taxes on them. Try living in Canada and having your dividends taxed at 30%+.

This post is dangerously misleading.

Kirk Doherty

January 18, 2026 AT 05:30My dad bought his first stock in '87. Didn't know what he was doing. Just put $200 in and didn't touch it. Now he's got enough to retire.

That's it. No fancy stuff. No apps. No podcasts.

Just buy and wait.

Dmitriy Fedoseff

January 19, 2026 AT 07:10Western finance teaches us to own shares like they're trophies. But what if wealth isn't about ownership at all? What if it's about freedom from the system that demands you own things to be secure?

I admire those who invest wisely-but I wonder if we're just playing a game designed to keep us distracted from true abundance: time, community, silence.

Still, I don't judge. If this path brings peace, then it's valid. Just don't call it 'wealth-building' as if it's the only way.

Meghan O'Connor

January 20, 2026 AT 00:37You say '10.2% average return'-but you didn't account for survivorship bias. The S&P 500 didn't exist in 1990 the way it does now. Companies that failed were removed. You're glorifying a curated list.

Also, 'invest $300/month'-sure, if you're not living paycheck to paycheck. Most people can't. This post is for the privileged.

And where's the data on the 80% who lose money? Cite your source. You didn't. That's lazy.

Morgan ODonnell

January 20, 2026 AT 19:00I read this after my mom told me to start investing. I was 22, broke, scared.

So I opened a Schwab account. Put in $25. Set it to auto-invest $50 every payday.

Didn't check it for two years. Then I looked. It had doubled.

Now I'm 27. I don't care about stocks anymore. I care that I don't panic anymore.

That’s the real win.

Nathaniel Petrovick

January 21, 2026 AT 20:40@Kirk Doherty - that’s exactly it. I remember when I first checked my portfolio after 18 months and saw it had gone up 12%. I cried. Not because of the money. Because I proved to myself I could stick with something hard.

That’s the secret. Not the returns. The discipline.

Thanks for saying it so simply.