Most people think building wealth means working harder, getting a raise, or winning the lottery. The truth? It’s not about how much you earn. It’s about how you use what you have. The real blueprint for building wealth isn’t hidden in fancy financial jargon or secret stock tips. It’s in consistent, smart investments-the kind that grow quietly over time while you sleep, work, or live your life.

Why Most People Stay Broke (Even When They Earn Well)

Take a look around. You’ll find people making $80,000 a year living paycheck to paycheck. Others making $40,000 own homes, have retirement accounts, and travel without debt. What’s the difference? It’s not income. It’s behavior.

Most people treat money like a faucet-turn it on, let it flow out. They spend first, save what’s left. That’s backwards. Wealth builders do the opposite: they pay themselves first. Every dollar they earn gets split before it hits their checking account. A portion goes to savings. Another to investments. Only then do they spend.

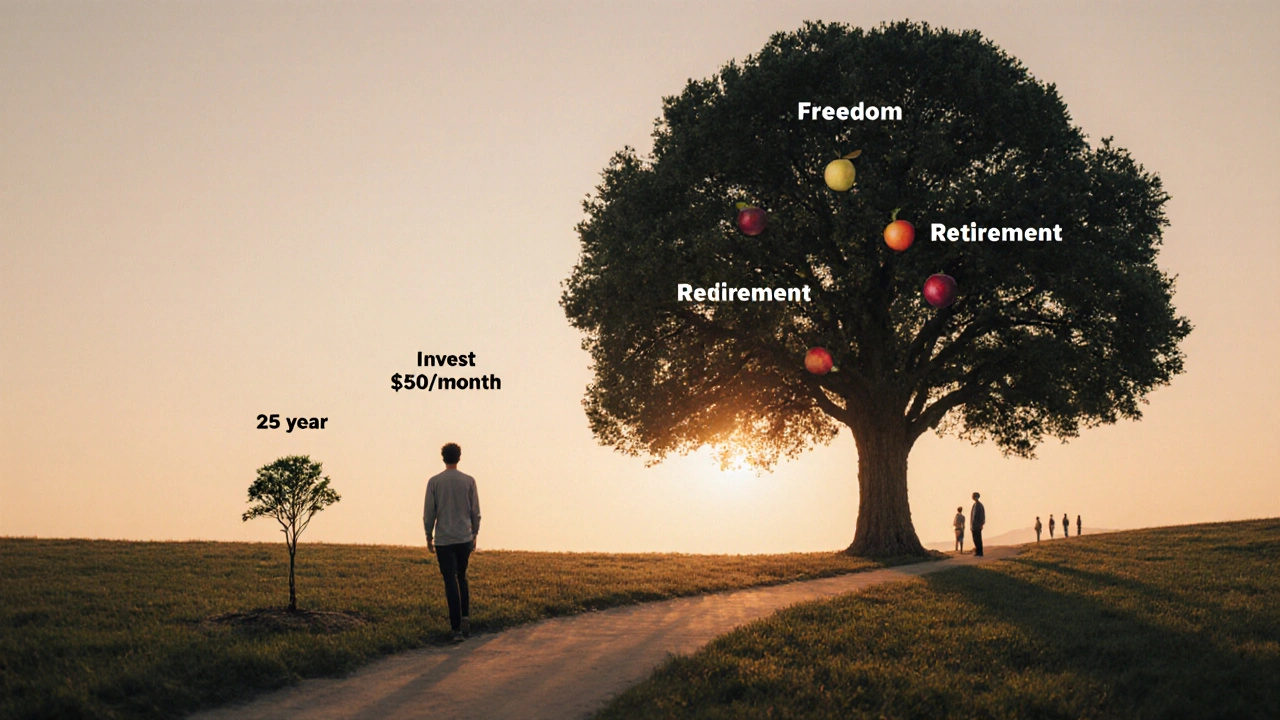

And here’s the kicker: they don’t wait for the perfect moment. They start with what they have. $50 a month. $200 a month. Doesn’t matter. What matters is starting-and staying consistent.

The Three Pillars of Wealth-Building Investments

There are three types of investments that form the foundation of real wealth. Not speculation. Not crypto gambling. Not get-rich-quick schemes. These are the tools that have built generational wealth for over a century.

- Stocks - Owning pieces of businesses. Not just Apple or Tesla. Think index funds like the S&P 500. Since 1926, the S&P 500 has returned about 10% annually on average. That’s not magic. That’s compounding.

- Real Estate - Rental properties, REITs, or even owning your home outright. Real estate doesn’t just appreciate. It pays you monthly rent. In 2024, the average U.S. rental property yielded 8.5% return on investment in mid-tier markets like Atlanta and Phoenix.

- Business Ownership - Not necessarily quitting your job to open a restaurant. It could be a side hustle that scales: an online store, a digital product, a service you automate. Small businesses that generate $100,000+ in annual profit are the #1 source of new millionaires in America, according to a 2023 IRS study.

These aren’t options. They’re requirements. You don’t need all three right away. But if you’re serious about wealth, you need exposure to at least two.

Asset Allocation: How to Split Your Money Without Guessing

Putting all your money in one place is like driving with one tire. You might get somewhere-but you’re one flat away from disaster.

Here’s a simple, proven allocation for most people:

| Age Group | Stocks | Real Estate | Bonds/Cash | Business/Alternative |

|---|---|---|---|---|

| 20-30 | 80% | 10% | 5% | 5% |

| 31-45 | 70% | 15% | 10% | 5% |

| 46-60 | 60% | 20% | 15% | 5% |

| 61+ | 50% | 25% | 20% | 5% |

This isn’t gospel. It’s a starting point. The goal isn’t to maximize returns-it’s to maximize survival. You want to ride out market crashes without panicking and selling low. That’s why bonds and cash matter. They’re your shock absorbers.

And real estate? It’s your inflation shield. When prices rise, so do rents. Stocks rise too-but they’re volatile. Real estate gives you cash flow while you wait.

The Power of Compounding (And Why You Can’t Afford to Wait)

Let’s say you invest $300 a month starting at age 25. You earn 8% average annual returns. By 65, you’ll have $1.1 million.

Now, let’s say you wait until 35 to start. Same $300 a month. Same 8% return. By 65? You’ll have $500,000. Half.

That’s compounding. It doesn’t care how smart you are. It cares how early you start. And how long you stay in.

People think they need $10,000 to begin. They don’t. You can start with $50. Use apps like Robinhood, M1 Finance, or even your employer’s 401(k) with automatic contributions. The system works even with tiny amounts-if you let it.

What to Avoid Like the Plague

There are traps everywhere. And they’re designed to look like opportunities.

- Day trading - Less than 1% of day traders consistently profit over five years, according to a 2024 study by the University of California. It’s gambling with a spreadsheet.

- Penny stocks - These are mostly manipulated by groups online. The average penny stock loses 90% of its value within two years.

- Buying luxury cars or designer clothes as "investments" - They depreciate. Fast. A $70,000 car is worth $35,000 after three years. That’s not wealth. That’s a money leak.

- Following TikTok gurus - If someone’s selling you a course on how to "get rich in 30 days," they’re selling you a dream. Not a strategy.

True wealth is boring. It’s consistent. It’s quiet. It doesn’t shout. It doesn’t trend. It just grows.

How to Start Today (No Excuses)

You don’t need a finance degree. You don’t need to be rich. You just need to take one step.

- Open a brokerage account (Fidelity, Charles Schwab, or Vanguard). They have $0 minimums.

- Set up automatic transfers: $50, $100, $200-whatever you can spare. Do it the day after payday.

- Buy an S&P 500 index fund (like VOO or SPY). That’s it. You’re now an investor.

- Read one book: The Simple Path to Wealth by JL Collins. It’s 150 pages. No jargon. Just truth.

- Repeat. Every month. No matter what.

That’s the blueprint. No fluff. No hype. Just action.

What Happens When You Stick With It

Five years in, you’ll start noticing things. Your savings account grows faster than your spending. You stop worrying about raises. You stop comparing yourself to others on social media.

Ten years in, you’ve paid off debt. You have a rental property. You’re earning $1,500 a month in dividends. You don’t need to work forever.

Twenty years in? You’re not rich by Hollywood standards. But you’re free. You can retire early. You can take a sabbatical. You can start that business you always talked about. You don’t have to beg for permission from a boss.

Wealth isn’t about having a mansion. It’s about having choices. And the only way to buy choices is through smart, long-term investments.

Can I build wealth with just $100 a month?

Yes. $100 a month invested in an S&P 500 index fund at 8% average return will grow to over $150,000 in 30 years. That’s not life-changing money-but it’s enough to cover emergencies, fund a vacation, or give you breathing room. The real power isn’t in the amount-it’s in the consistency. Starting small beats waiting for "perfect timing" every time.

Is real estate still a good investment in 2025?

Yes, but not everywhere. In 2025, markets like Austin, Nashville, and Tampa still offer strong rental yields (7-9%) with steady appreciation. Cities with high taxes, strict rent control, or declining populations (like Detroit or Chicago) are riskier. The key is location, cash flow, and long-term holding. Don’t buy to flip. Buy to hold and rent.

Should I invest in crypto or Bitcoin?

Only if you can afford to lose it. Bitcoin has grown significantly over the past decade, but it’s extremely volatile. It’s not a stable asset like stocks or real estate. Treat it like a speculative bet-not a core part of your wealth-building plan. If you want exposure, allocate no more than 1-5% of your portfolio. Never use borrowed money.

What’s the biggest mistake people make when investing?

They panic and sell during market downturns. In 2020, the S&P 500 dropped 34% in under a month. Those who sold lost everything. Those who held? They recovered by year-end and hit new highs by 2021. The market always recovers. Emotions don’t. Stick to your plan. Don’t react to headlines.

Do I need a financial advisor to build wealth?

Not unless you’re dealing with complex tax situations, estate planning, or over $1 million in assets. For most people, a low-cost index fund portfolio managed through a platform like Vanguard or Fidelity is better than paying 1% annual fees to an advisor. You can learn the basics in a weekend. Free resources like Bogleheads.org and the White Coat Investor blog are more helpful than most paid advisors.

Final Thought: Wealth Is a Habit, Not a Goal

You don’t wake up one day and become wealthy. You wake up every day and choose to invest. To save. To delay gratification. To ignore the noise. To keep going when nothing seems to be happening.

That’s the blueprint. It’s simple. It’s not exciting. But it works-every single time.

Mark Nitka

November 4, 2025 AT 14:06Man, I started with $50 a month in VOO back in 2020 and now I’ve got over $22k. No magic, just consistency. I used to think I needed a big salary to get ahead - turns out I just needed to stop spending on dumb shit like subscription services I never used.

Kelley Nelson

November 5, 2025 AT 17:07While I appreciate the sentiment, the underlying assumption that index funds are a panacea is rather reductive. One must consider the structural decay of capitalist equity markets, particularly in light of the Federal Reserve’s monetary policies and the increasing concentration of market capitalization within a handful of tech conglomerates. The historical 10% return is a statistical artifact, not a guarantee.

Aryan Gupta

November 7, 2025 AT 09:17Index funds? HA. You think the SEC isn't rigged? The S&P 500 is manipulated by Wall Street bots and the Fed's QE programs. And real estate? Try renting in 2025 - landlords are all hedge funds now. They're buying up homes to evict families and flip them into Airbnbs. This whole 'invest and sleep' thing is a scam for the middle class to keep paying rent while the elite get richer. Also, your math is wrong - inflation eats 7% a year, not 3%. You're losing money.

Fredda Freyer

November 8, 2025 AT 04:59The real insight here isn’t the asset allocation - it’s the behavioral shift. Most people treat money like a resource to be managed, when it’s actually a tool for freedom. The brilliance of compounding isn’t in the numbers - it’s in the discipline to keep showing up when nothing seems to be happening. I’ve seen people with $200k salaries bankrupt themselves because they never learned to delay gratification. Meanwhile, my neighbor who works as a dental hygienist and invests $150/month has more net worth than half the finance bros on LinkedIn. It’s not about income. It’s about identity. Are you a spender? Or are you a builder?

And yes - starting with $50 matters. Not because $50 is enough, but because doing something small builds the habit. And habits are the architecture of destiny.

Gareth Hobbs

November 8, 2025 AT 22:42Ugh, another 'buy VOO and chill' post... typical american delusion. We're all being played by the banks and the fed. And real estate? Pfft. In the UK we know better - property prices are collapsing in London, and the government's just printing money to bail out the rich. You think your 8% return is real? Inflation's at 7.5% here, and your 'safe' investments are just paper. Also, why do Americans always ignore gold? It's the only real money. And crypto? Nah, that's just digital tulips. Stick to cash under the mattress - it's the only thing that can't be hacked or taxed.

Zelda Breach

November 10, 2025 AT 07:57Wow. A 10% return on stocks since 1926? Let me guess - you didn't adjust for inflation, taxes, or fees. Also, the S&P 500 didn't even exist until 1957. And your 'proven allocation' ignores that bonds have returned less than 2% annually for the last decade. Your entire argument is built on cherry-picked data and nostalgia. If this is your blueprint, you're not building wealth - you're just hoping the next sucker pays more for your overpriced index fund shares.

Alan Crierie

November 11, 2025 AT 04:05Really loved this. I’m 28 and started with $25 a month in a Vanguard fund - didn’t even know what ETFs were. Now I’ve got over $10k and I’m learning about REITs. The thing that changed everything? I stopped checking my balance every day. I used to panic when it dipped. Now I just set it and forget it. Also, reading JL Collins was a game-changer - no jargon, just clarity. Thanks for reminding me that wealth isn’t flashy. It’s just… steady.

And yes - I still buy coffee. But now I make it at home. Small wins add up.

Nicholas Zeitler

November 11, 2025 AT 08:37YES. YES. YES. Start small. Stay consistent. Ignore the noise. I’ve been telling people this for years - and they always say, 'I need more money to start.' NO. YOU NEED MORE DISCIPLINE. I started with $10 a week. Now I’m at $500 a month. The math doesn’t lie. Compound interest is the eighth wonder of the world - and you’re not using it. Stop waiting for the 'right time.' The right time was yesterday. The next best time? TODAY.

Teja kumar Baliga

November 12, 2025 AT 17:23From India here - and this hits home. My uncle started investing ₹2,000/month (about $25) in 1998. Now he’s retired early. No fancy degrees. Just patience. In India, people think you need lakhs to begin. But even ₹500/month in a good index fund works. The system is the same everywhere. Start. Stay. Simple.

k arnold

November 12, 2025 AT 20:09So you’re telling me I should trade my weekend beer money for a VOO ETF? And call that wealth? Bro, I’ve got a 401(k) and a used Honda. You’re not building wealth - you’re just doing what the banks told you to do so they can keep charging you fees. Congrats. You’re a good little capitalist.