Risk-Reward Calculator

Trade Risk Analysis

Ever wondered why some people seem to turn a few dollars into a solid nest egg while you’re still stuck on the sidelines? The answer isn’t magic-it’s a clear, repeatable roadmap for stock trading roadmap. Follow the steps below, avoid common traps, and you’ll see how disciplined trading can become a reliable part of your financial future.

Key Takeaways

- Start with a reputable brokerage and a well‑defined capital plan.

- Learn the three core order types and when to use each.

- Blend technical and fundamental analysis for balanced decision‑making.

- Apply strict risk‑management rules to protect your account.

- Build the right mindset-discipline beats intuition every time.

Understanding Stock Trading

When you hear the term stock trading is the buying and selling of shares in publicly listed companies to capture price movements, the first thing to grasp is that you’re entering a market that operates 24/5, reacts to news instantly, and is influenced by both macro trends and company‑specific events.

Building Your Trading Foundation

Before you place a single trade, you need three building blocks:

- Brokerage account is the online platform that connects you to stock exchanges, provides order execution, and offers research tools. Choose one with low commissions, solid customer support, and robust security.

- Capital allocation is the amount of money you set aside for trading, typically no more than 10‑20% of your total investable assets. Treat it as a separate budget to keep emotions in check.

- Diversification is the practice of spreading your investment across different sectors, industries, and asset classes to reduce risk. Even in a focused trading strategy, avoid putting all dollars into a single ticker.

Choosing the Right Order Types

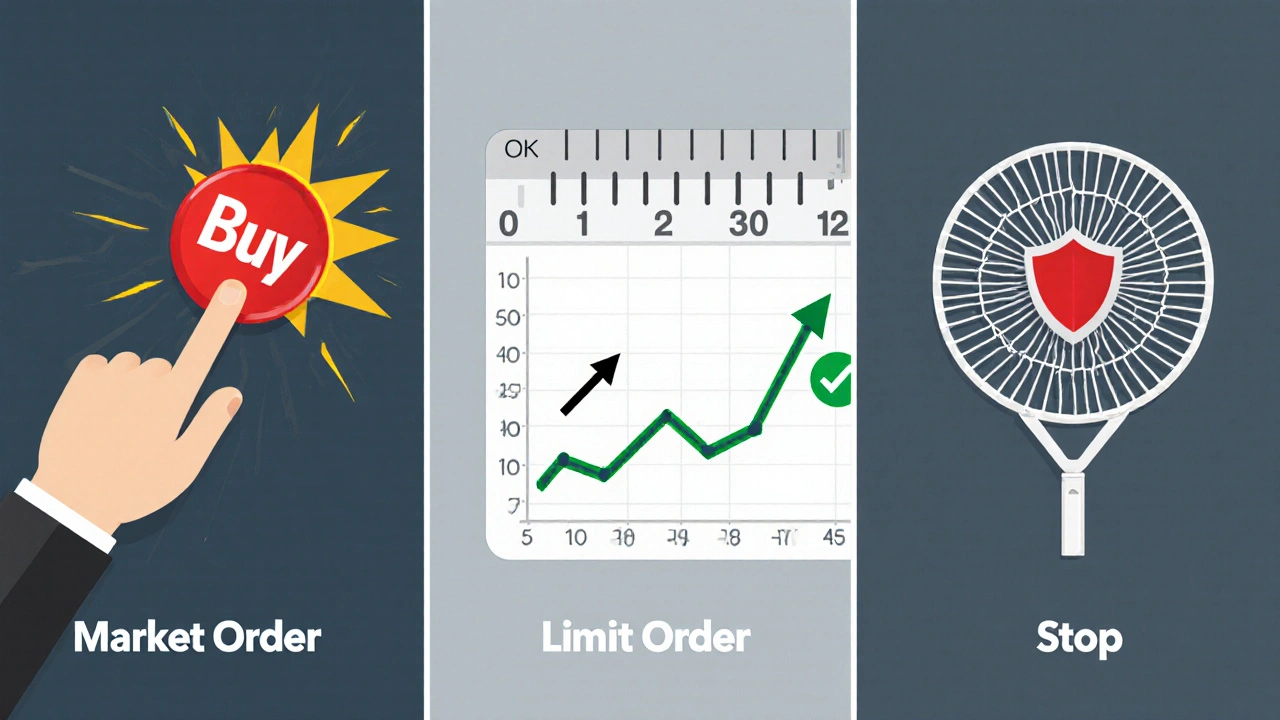

Every trade starts with an order. The three most common are market, limit, and stop orders. Understanding their mechanics can save you from costly slippage.

| Order Type | Execution Speed | Price Control | Typical Use |

|---|---|---|---|

| Market | Instant | None (fills at best available price) | When you need rapid entry/exit |

| Limit | Variable (executes only at set price or better) | High (you set max buy or min sell price) | When you have a specific entry point |

| Stop | Triggers a market order once stop price is hit | Low (price can slip after trigger) | Protective stop‑loss or breakout entry |

Use market orders for fast, high‑liquidity stocks, limit orders when you want precise entry, and stop orders to automate risk protection.

Analyzing the Market

Two pillars guide most successful traders: technical analysis and fundamental analysis.

- Technical analysis is the study of price charts, patterns, and indicators to forecast short‑term moves. Common tools include moving averages, RSI, and volume spikes.

- Fundamental analysis is the evaluation of a company’s financial health, earnings reports, and macro‑economic factors to gauge long‑term value. Look at P/E ratios, debt levels, and revenue growth.

Blend both: use fundamentals to pick high‑quality stocks, then apply technicals to time entries and exits.

Managing Risk

Even the best analysis can’t eliminate uncertainty. That’s why disciplined risk management is non‑negotiable.

- Position sizing is the method of determining how many shares to buy based on your risk per trade, often 1‑2% of total capital. It prevents a single loss from wiping out your account.

- Stop‑loss orders are pre‑set price levels that automatically close a position to limit downside. Place them just beyond key support levels.

- Risk‑reward ratio is the comparison of potential profit to potential loss, ideally 2:1 or higher. Only take trades that meet this threshold.

Track your drawdowns, keep a trading journal, and adjust your size when you’re on a losing streak.

Trading Psychology

Numbers tell part of the story; your mind tells the rest.

- Discipline is the ability to follow your plan consistently, regardless of market noise. Set rules and stick to them.

- Fear and greed are the emotional forces that cause premature exits or over‑extension. Recognize them early and pause before acting.

- Continuous learning is the habit of reviewing trades, reading market news, and refining strategies. The market evolves; so should you.

Morning routines, meditation, or a simple checklist can keep emotions in check and improve execution.

Your Step‑by‑Step Stock Trading Roadmap

- Open a reputable brokerage account and fund it with a dedicated capital pool.

- Define your trading goal (e.g., 10% annual return) and risk tolerance.

- Choose a niche-tech stocks, dividend play, or swing trades.

- Develop a simple strategy that combines a fundamental screen with a technical entry rule.

- Backtest the strategy on historical data for at least six months.

- Start with a paper‑trading or micro‑size position to validate real‑time performance.

- Apply strict risk‑management: set stop‑loss, calculate position size, and review each trade in a journal.

- Scale up gradually as your win rate and confidence improve.

Follow these steps, stay patient, and you’ll turn the volatile world of stocks into a predictable income stream.

Frequently Asked Questions

How much money do I need to start stock trading?

There’s no magic minimum, but most experts recommend at least $1,000‑$2,000 for a realistic learning curve. This amount lets you diversify a few positions while keeping each trade small enough to manage risk.

What’s the difference between a market order and a limit order?

A market order executes immediately at the best available price, which can lead to slippage in fast markets. A limit order sets a price ceiling (for buys) or floor (for sells) and only fills if the market reaches that level.

How do I choose between technical and fundamental analysis?

Use fundamentals to pick solid companies with good earnings, growth, and valuation. Then apply technical tools to time entry and exit points. Combining both gives a higher probability of success.

What is a good risk‑reward ratio for a trade?

Aim for at least 2:1, meaning you expect to make twice as much as you risk. This allows you to stay profitable even if you win only half of your trades.

How can I keep emotions out of my trading decisions?

Create a written trading plan, set stop‑losses before each trade, and stick to a pre‑determined position size. Review your trades daily and treat each loss as data, not a personal failure.

Liam Hesmondhalgh

October 14, 2025 AT 08:38The so‑called "Roadmap" reads like a manifesto for blind speculation, and it betrays a shallow understanding of risk management. As someone who values disciplined investing, I find the emphasis on quick profits alarmingly reckless. It's time we stop glorifying gambling and start teaching true financial stewardship.

Patrick Tiernan

October 21, 2025 AT 06:13Wow this roadmap is kinda… overhyped! It sounds like a hype train with no brakes.

Patrick Bass

October 28, 2025 AT 02:30The risk‑reward calculator could be useful, but the interface is confusing. A clearer layout would help beginners navigate it.

Colby Havard

November 3, 2025 AT 23:46One must consider the ethical implications of encouraging uninformed individuals to engage in speculative trading; the allure of quick gains often obscures the profound responsibility we bear toward financial stability. Moreover, the roadmap neglects to address the systemic risks that such practices impose upon the broader economy; it tacitly endorses a culture of short‑termism. Prudence and education should be paramount, not mere profit‑target calculations. In light of these considerations, a more balanced approach is imperative.

Amy P

November 10, 2025 AT 21:03Honestly, this feels like a roller‑coaster of emotions; the excitement of potential profit is palpable, yet the dread of loss looms large. The interactivity is slick, almost theatrical, drawing you into a dance of numbers. Still, one can't help but wonder if the thrill outweighs the practical value. It’s a dazzling show, but does it teach you to survive the market’s harsh lights?

adam smith

November 17, 2025 AT 18:20This guide is clear and concise. It offers a straightforward way to calculate risk.

Mongezi Mkhwanazi

November 24, 2025 AT 15:36First, let us acknowledge the earnest attempt to demystify the arcane world of stock trading; however, the execution betrays a profound lack of depth. The roadmap, while ostensibly comprehensive, skims the surface of a discipline that demands relentless study and disciplined practice. It offers a risk‑reward calculator but fails to contextualize its outputs within a broader strategic framework. Moreover, the interface, adorned with glossy visual elements, distracts rather than enlightens, fostering a false sense of mastery. In practice, a trader must grapple with market psychology, macro‑economic signals, and the inevitable volatility that no mere calculator can encapsulate. The omission of position sizing guidelines is a glaring oversight; without proper sizing, even the most promising setups can lead to catastrophic losses. Additionally, the guide glosses over tax implications, an essential consideration for any serious investor. One must also question the provenance of the data feeding into these calculations; are they sourced from reliable, real‑time feeds, or are they merely placeholders? Validation of inputs is a cornerstone of any robust analysis, yet this roadmap offers no verification mechanisms. The lack of scenario analysis further limits its utility; traders should be able to model best‑case, worst‑case, and median outcomes. In its current form, the roadmap risks encouraging a reckless, “set‑and‑forget” mentality, which stands in stark contrast to the iterative, reflective approach championed by seasoned professionals. Finally, the absence of a community or mentorship component leaves users isolated, depriving them of the collective wisdom that often shields novices from costly errors. In sum, while the roadmap exhibits a veneer of sophistication, it ultimately falls short of delivering the rigorous, holistic guidance required for sustainable financial success.

Mark Nitka

December 1, 2025 AT 12:53I respect the effort put into this tool, but we should encourage collaborative learning rather than solitary speculation. Constructive dialogue can help mitigate risky behavior.

Kelley Nelson

December 8, 2025 AT 10:10While the roadmap presents an aesthetically pleasing interface, its substantive content inevitably falls short of the rigorous analytical standards one expects from a truly elite financial discourse.

Aryan Gupta

December 15, 2025 AT 07:26The notion that a simple calculator can replace thorough due diligence is absurd; the markets are rigged by unseen forces, and any tool that pretends otherwise is misleading. One must remain vigilant about the hidden agendas driving price movements.

Fredda Freyer

December 22, 2025 AT 04:43From a philosophical standpoint, the roadmap invites reflection on the relationship between risk and reward, prompting us to consider how our choices shape our financial destiny. Practically, pairing the calculator with disciplined journaling can greatly enhance learning outcomes.

Gareth Hobbs

December 29, 2025 AT 02:00Honestly mate, this whole thing reeks of the same old financial propaganda; they’re pushing a narrative that suits the elite, while we’re left to chase after elusive gains. Stay woke.

Richard H

January 4, 2026 AT 23:16The roadmap is overly simplistic.