Technical Analysis: Your Roadmap to Smarter Trading

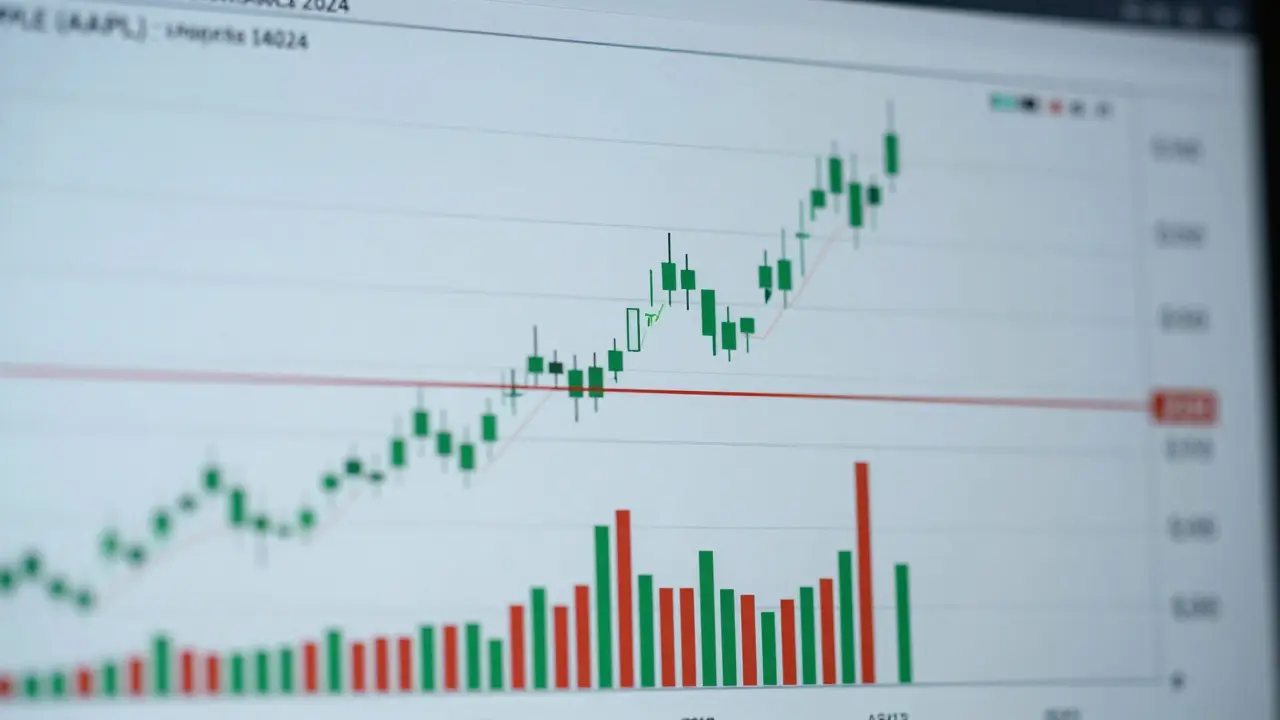

When working with Technical Analysis, the practice of evaluating securities through price charts, volume patterns, and statistical indicators. Also known as chart analysis, it helps traders spot trends and make data‑driven decisions. By focusing on price action rather than company fundamentals, you get a quick pulse on market sentiment. This approach is especially powerful when you pair it with other core concepts like stock trading, risk management, and investment strategies.

Take stock trading, the act of buying and selling shares in public markets as an example. Technical analysis provides the entry and exit signals that many traders rely on to time their trades. The relationship can be expressed as a simple triple: Technical analysis enables stock trading decisions. When you learn to read candlesticks, support levels, and moving averages, you reduce guesswork and increase confidence.

But a good entry is only half the battle. Risk management, the systematic process of identifying, assessing, and controlling trading losses is the other half. Technical analysis and risk management intersect constantly – a tight stop‑loss based on a recent swing low is a classic example of a technical rule that directly supports risk control. This creates the semantic link: Effective risk management strengthens technical analysis outcomes.

Every trader also needs a broader investment strategy, a plan that defines goals, time horizon, and asset allocation. Whether you follow a momentum‑driven approach or a mean‑reversion style, your chosen strategy dictates which technical tools you prioritize. For instance, a trend‑following strategy leans heavily on moving averages, while a breakout strategy focuses on volume spikes and chart patterns. This relationship forms another triple: Investment strategies shape the selection of technical indicators.

Core Concepts You’ll Master

Across the articles below you’ll explore key market indicators such as Relative Strength Index, Bollinger Bands, and MACD. You’ll see how these indicators create signals that plug straight into stock trading setups, reinforce risk management rules, and align with specific investment strategies. You’ll also learn how chart patterns – head‑and‑shoulders, double tops, flags – act as visual cues that help you anticipate price moves before they happen. Together, these elements cover the full spectrum: technical analysis encompasses chart patterns, requires an understanding of market indicators, and works best when integrated with stock trading, risk management, and a solid investment plan.

Ready to go deeper? Below you’ll find a curated collection of articles that break down each concept, from beginner‑friendly guides to advanced tactics. Dive in and start turning data into decisive trades.

Stock Trading: How to Decode Market Trends

- Lorcan Sterling

- 10 Comments

Learn how to decode stock market trends using price action, volume, and support/resistance levels-no indicators needed. Stop guessing and start reading what the market actually shows.

Read moreInsider Secrets to Becoming a Stock Trading Guru

- Lorcan Sterling

- 9 Comments

Discover the real secrets behind becoming a profitable stock trader-not through flashy indicators, but through discipline, risk management, and psychological control. Learn what actually works in today's market.

Read moreStock Trading: How to Ride the Market Waves

- Lorcan Sterling

- 14 Comments

Learn how to ride market waves in stock trading by reading price action, using multiple timeframes, and sticking to clear entry and exit rules. No guesswork, just strategy.

Read more10 Proven Strategies to Boost Your Stock Trading Skills

- Lorcan Sterling

- 12 Comments

Discover ten actionable strategies that sharpen technical analysis, risk management, psychology, and more, helping you trade stocks with confidence and consistency.

Read moreThe Science of Stock Trading: How to Make Informed Decisions with Data, Not Emotion

- Lorcan Sterling

- 15 Comments

Learn how to make informed stock trading decisions using data, not emotion. Discover the science behind fundamental and technical analysis, trading psychology, and proven strategies that work in real markets.

Read more