Starting with investments doesn’t mean you need a finance degree, a fancy app, or a six-figure salary. It just means you’re ready to make your money work for you instead of just sitting in a bank account earning almost nothing. If you’ve ever felt overwhelmed by terms like ETFs, dividends, or asset allocation, you’re not alone. Most people feel that way-until they break it down into simple, doable steps.

Why Start Investing Now?

Money left in a savings account today loses value over time. Inflation in 2025 is still around 2.8%, meaning if your savings earn 0.5% interest, you’re actually losing 2.3% in buying power every year. That’s not a typo. Keeping cash safe feels smart, but it’s slowly costing you.

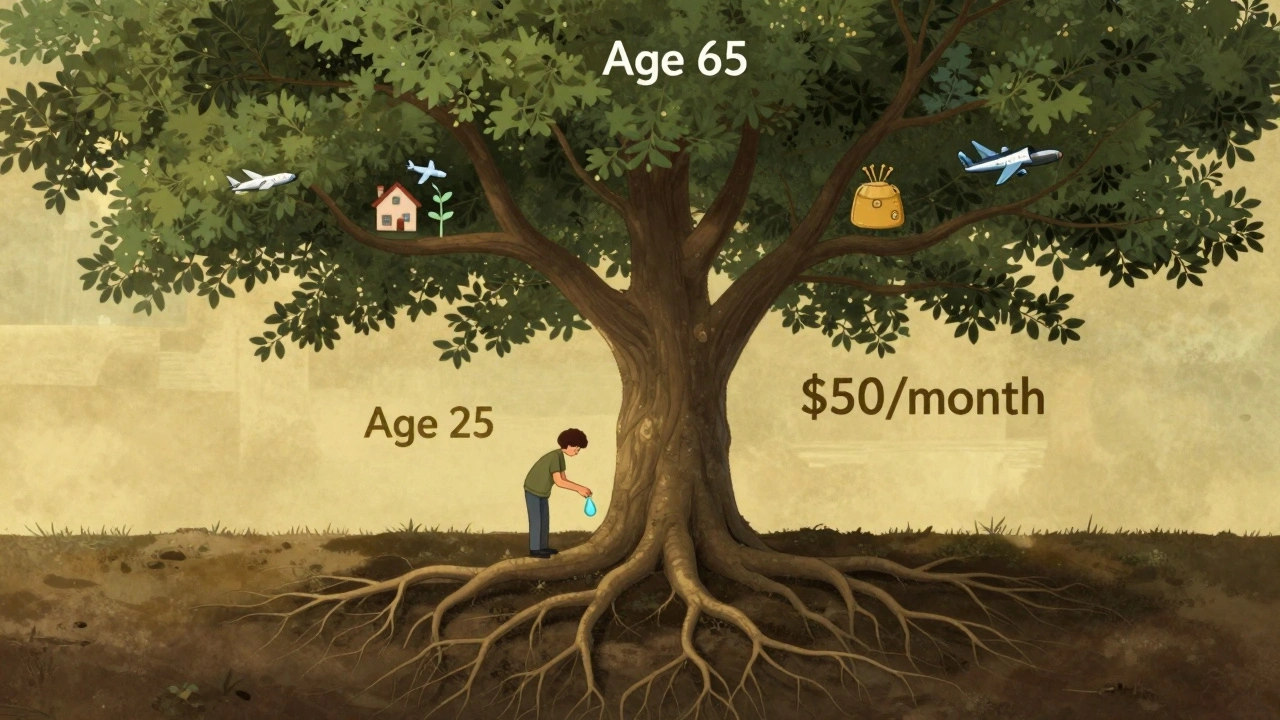

On the other hand, the stock market has returned an average of 7% to 10% per year over the last 90 years, even after accounting for crashes and recessions. You don’t need to time the market. You just need to start early and stay consistent. Someone who invests $200 a month starting at age 25 could have over $500,000 by 65, assuming a 7% average return. Wait until 35, and that number drops to around $230,000. Time isn’t just helpful-it’s your biggest advantage.

What Are You Actually Investing In?

Investing isn’t just about buying stocks. It’s about owning pieces of things that generate value. Here’s what you’re really buying when you invest:

- Stocks - Small ownership shares in a company. If Apple makes more profit, its stock price usually goes up.

- Bonds - Loans you give to governments or companies. They pay you fixed interest over time and return your money later.

- ETFs (Exchange-Traded Funds) - Baskets of hundreds of stocks or bonds bundled together. Buy one ETF, and you own a little piece of dozens or even thousands of companies.

- Mutual Funds - Similar to ETFs, but usually more expensive and traded only once a day.

- Real Estate (REITs) - You can invest in property without buying a house. REITs are companies that own apartments, warehouses, or malls and pay you a share of the rent.

Most beginners should focus on ETFs. Why? Because they’re cheap, easy to understand, and spread your risk. Instead of betting on one company like Tesla or Netflix, you’re betting on the whole market. That’s safer.

How to Start With Just $50

You don’t need $1,000 to begin. Apps like Vanguard, Fidelity, or even Robinhood let you start with $1 or $5. Here’s how to do it in five minutes:

- Choose a brokerage account. Pick one with no fees and no minimum balance. Vanguard’s Personal Investor or Fidelity’s Zero-Fee ETFs are good options.

- Link your bank account. You’ll need your routing and account numbers.

- Buy a broad-market ETF. Look for VTI (Vanguard Total Stock Market ETF) or VTI is the best starting point for beginners. It holds nearly 4,000 U.S. stocks-from Apple to small local businesses.

- Set up automatic investing. Schedule $25 or $50 to be pulled from your bank every two weeks. This is called dollar-cost averaging. You buy more when prices are low, less when they’re high. No guessing required.

- Ignore the noise. Don’t check your balance every day. Don’t follow TikTok gurus telling you to buy Dogecoin. Stick to your plan.

That’s it. You’ve started investing. No complex formulas. No stock-picking. Just consistent, simple action.

Common Mistakes Beginners Make (And How to Avoid Them)

Most people fail at investing not because they’re bad with money-but because they make predictable mistakes.

- Mistake: Waiting for the "perfect time" to invest. Fix: There is no perfect time. The best time to start was yesterday. The second best is today.

- Mistake: Chasing hot stocks. Fix: If you’re hearing about a stock from a friend or YouTube, it’s probably already priced too high. Stick to broad ETFs.

- Mistake: Selling during a crash. Fix: Markets drop about once every 2 years. If you sell when things look bad, you lock in losses. Stay invested. History shows markets always recover.

- Mistake: Paying too much in fees. Fix: Avoid mutual funds with expense ratios above 0.5%. ETFs like VTI cost just 0.03%-meaning you pay 30 cents for every $1,000 invested.

- Mistake: Thinking you need to be an expert. Fix: You don’t need to understand balance sheets or P/E ratios to get rich over time. You just need to start, save, and stay patient.

What to Do After You’ve Started

Once you’ve got your first $500 invested, here’s your next move:

- Build a small emergency fund (3-6 months of living expenses) in a high-yield savings account. This keeps you from dipping into investments during tough times.

- Contribute to a retirement account if your job offers one. A 401(k) with employer matching is free money. If they match 50% up to 6% of your salary, contribute at least 6%. That’s a 50% return on your money-guaranteed.

- Consider adding a bond ETF like BND (Vanguard Total Bond Market ETF) once you have $5,000 saved. This helps reduce risk as you grow older.

- Rebalance once a year. If your ETF grew and now makes up 90% of your portfolio, sell a little and buy more bonds to bring it back to your target (like 80% stocks, 20% bonds).

That’s all you need to know. No complex trading. No technical analysis. Just simple, repeatable habits.

Real People, Real Results

Take Sarah, 28, who started investing $75 a month in VTI after reading a Reddit thread. She didn’t touch it for five years. In 2024, her account hit $6,200. She didn’t time the 2022 crash or the 2023 rally. She just kept adding money. Now she’s thinking about buying a house.

Or James, 32, who invested $200 a month from his side hustle. He started in 2020. By 2025, his portfolio was worth $17,800. He never bought a single stock. He just stuck to his plan.

You don’t need to be rich to start. You just need to start.

What’s Next?

Investing isn’t about getting rich quick. It’s about getting steady over time. The goal isn’t to beat the market. It’s to be in the market-long enough to let compounding do its job.

Here’s your next step: Open that brokerage account today. Set up your first $50 transfer. Don’t wait for tomorrow. Don’t wait until you "feel ready." You’re ready now. The only thing standing between you and your future self is one action.

Do I need a lot of money to start investing?

No. You can start with as little as $1. Many platforms like Vanguard, Fidelity, and Robinhood allow fractional shares, so you can buy a tiny piece of an ETF like VTI without needing hundreds of dollars. The key isn’t how much you start with-it’s that you start.

Is investing risky?

All investing carries some risk, but the biggest risk for beginners is not investing at all. Markets go up and down, but over 10+ years, they almost always rise. Spreading your money across hundreds of companies through ETFs reduces risk dramatically. If one company fails, it doesn’t hurt your portfolio much.

Should I pick individual stocks?

Not as a beginner. Picking individual stocks is like playing the lottery-you might win, but you’re far more likely to lose. Even professional investors struggle to beat the market consistently. Stick to broad-market ETFs like VTI or VT (which includes international stocks) until you’ve built a solid foundation.

How often should I check my investments?

Once every few months is enough. Checking daily or weekly leads to stress and bad decisions. Markets move every second, but your goals are years away. Focus on your contributions, not your balance. The less you look, the better you’ll do.

What’s the difference between a 401(k) and an IRA?

A 401(k) is offered through your employer and often comes with a company match-that’s free money. An IRA is opened by you personally and gives you more control over investment choices. If your employer offers a 401(k) match, contribute enough to get the full match first. Then consider an IRA for extra savings.

Can I lose all my money investing?

It’s extremely unlikely if you’re using low-cost, diversified ETFs like VTI. You won’t lose everything unless every company in the U.S. goes bankrupt-which has never happened. Even during the 2008 crash, the S&P 500 eventually recovered and grew past its previous high. The worst thing you can do is panic and sell.

Final Thought

You don’t need to be a Wall Street trader to build wealth. You just need to be consistent. Start small. Stay simple. Let time do the heavy lifting. The earlier you begin, the less you’ll need to save later. And the more freedom you’ll have when you’re ready to retire-or just take that trip, buy that house, or start that business.