Stock trading isn’t just for Wall Street brokers in suits. It’s something millions of regular people do every day-from teachers in Ohio to mechanics in Texas-using apps on their phones. But if you’ve ever looked at a stock chart and felt like it was written in another language, you’re not alone. The truth? Stock trading is simpler than most people make it out to be. But it’s also far more dangerous if you skip the basics.

What Exactly Is Stock Trading?

Stock trading means buying and selling shares of companies listed on public exchanges like the New York Stock Exchange or Nasdaq. When you buy a share, you’re buying a tiny piece of that company. If the company does well, the value of your share usually goes up. If it struggles, the value drops. Trading is different from investing. Investing means holding stocks for years, hoping they grow. Trading means buying and selling over days, weeks, or even minutes to profit from short-term price moves.

People trade for different reasons. Some want to make quick cash. Others use it as a side hustle to build wealth. A few treat it like a full-time job. But no matter your goal, the rules stay the same: understand the market, manage risk, and never trade with money you can’t afford to lose.

How Do You Actually Start Trading?

You don’t need a degree in finance or a six-figure salary to start. Here’s how real people begin:

- Choose a brokerage app. Popular ones like Robinhood, Fidelity, or Charles Schwab let you open an account with $0 minimum. Compare fees, tools, and ease of use.

- Link your bank account. Most apps let you transfer money in 1-3 business days.

- Start small. Put in $100 or $500. Don’t go all in.

- Buy one stock you understand. Think Coca-Cola, Apple, or Walmart-not some random crypto-trending ticker you saw on TikTok.

- Hold it for a week. Watch what happens. Don’t panic if it dips.

That’s it. You’ve traded. Now you know what it feels like. Most people skip these steps and jump straight into meme stocks or leveraged ETFs. That’s how accounts blow up.

The Three Biggest Mistakes New Traders Make

Let’s be blunt: 80% of new traders lose money in their first year. Why? Three reasons keep showing up in failure stories:

- Chasing hot tips. Someone on YouTube says “Buy GameStop now!” and you do it without knowing why. That’s gambling, not trading. You need to understand the company’s earnings, debt, and industry trends-not just the hype.

- Not using stop-losses. A stop-loss is an automatic sell order that kicks in if a stock drops below a certain price. It keeps you from losing half your account because you hoped it would bounce back. Most brokers let you set this in one click.

- Trading too much. Every trade costs money-fees, taxes, slippage. Frequent trading eats your profits faster than you think. One study from the University of California found that the most active traders earned 6.5% less per year than the least active ones, after fees.

These aren’t opinions. These are patterns from real account data. Avoid them, and you’re already ahead of most beginners.

Simple Strategies That Actually Work

You don’t need complex indicators or AI bots to make money. Here are three proven, low-stress approaches:

1. Buy and Hold Quality Stocks

This is the oldest trick in the book-and still the most reliable. Pick companies with strong balance sheets, steady profits, and growing dividends. Think Johnson & Johnson, Procter & Gamble, or Microsoft. Buy them when the market dips and hold for years. You won’t get rich overnight, but you’ll outperform 90% of day traders over a decade.

2. Dollar-Cost Averaging

Invest the same amount every month, no matter what the market does. For example, $200 on the 15th of each month. When prices are high, you buy fewer shares. When prices are low, you buy more. Over time, your average cost per share drops. This removes emotion from trading and works even if you don’t know how to read a chart.

3. Swing Trading with Moving Averages

If you want to trade more actively, try this: watch the 50-day and 200-day moving averages. When the 50-day crosses above the 200-day, it’s called a “golden cross” and often signals an upward trend. When it crosses below, it’s a “death cross” and may mean a drop is coming. You don’t need to predict the future. Just follow the trend. Buy when the trend turns up. Sell when it turns down.

These strategies aren’t magic. But they’re grounded in data, not memes.

What Tools Do You Actually Need?

You don’t need expensive software. Here’s what works for most people:

- Brokerage app: Robinhood for simplicity, Fidelity for research tools.

- Stock screener: Finviz.com lets you filter stocks by price, volume, earnings growth, and more-for free.

- News source: Bloomberg or Reuters for reliable business news. Avoid financial influencers on social media.

- Spreadsheet: Track your trades: date, stock, price, reason, outcome. This is your most important tool.

That’s it. No need for $500/month trading platforms or AI signal services. If someone’s selling you a “secret system,” they’re selling you a dream. Real trading is boring, consistent, and disciplined.

How Much Money Can You Make?

Let’s cut through the hype. Most people don’t get rich from trading. But many make steady, realistic gains.

Here’s a realistic scenario: You start with $5,000. You trade 2-3 times a month using dollar-cost averaging and swing trading. You aim for 5-8% annual returns-not 50%. After five years, you’ve doubled your money. That’s $10,000. Not life-changing, but better than leaving it in a savings account earning 0.5%.

Some people make 20%, 30%, even 50% in a year. But those are outliers. They also had big losses before they got there. If you’re looking for quick riches, you’re in the wrong game.

Real success in trading comes from consistency, not home runs.

How to Avoid Emotional Trading

The biggest enemy in trading isn’t the market. It’s you.

Fear makes you sell too early. Greed makes you hold too long. FOMO makes you buy at the top. These aren’t weaknesses-they’re human instincts. But you can train yourself to beat them.

- Write a trading plan before you open your app. What stock? Why? What’s your exit? Stick to it.

- Take weekends off. Don’t check your account every hour.

- Review your trades weekly. Not to see wins, but to see patterns. Did you follow your plan? Did emotion drive the decision?

One trader I know keeps a journal. Every trade gets a note: “Bought because earnings beat estimates. Sold because price hit target. No FOMO.” Simple. Powerful.

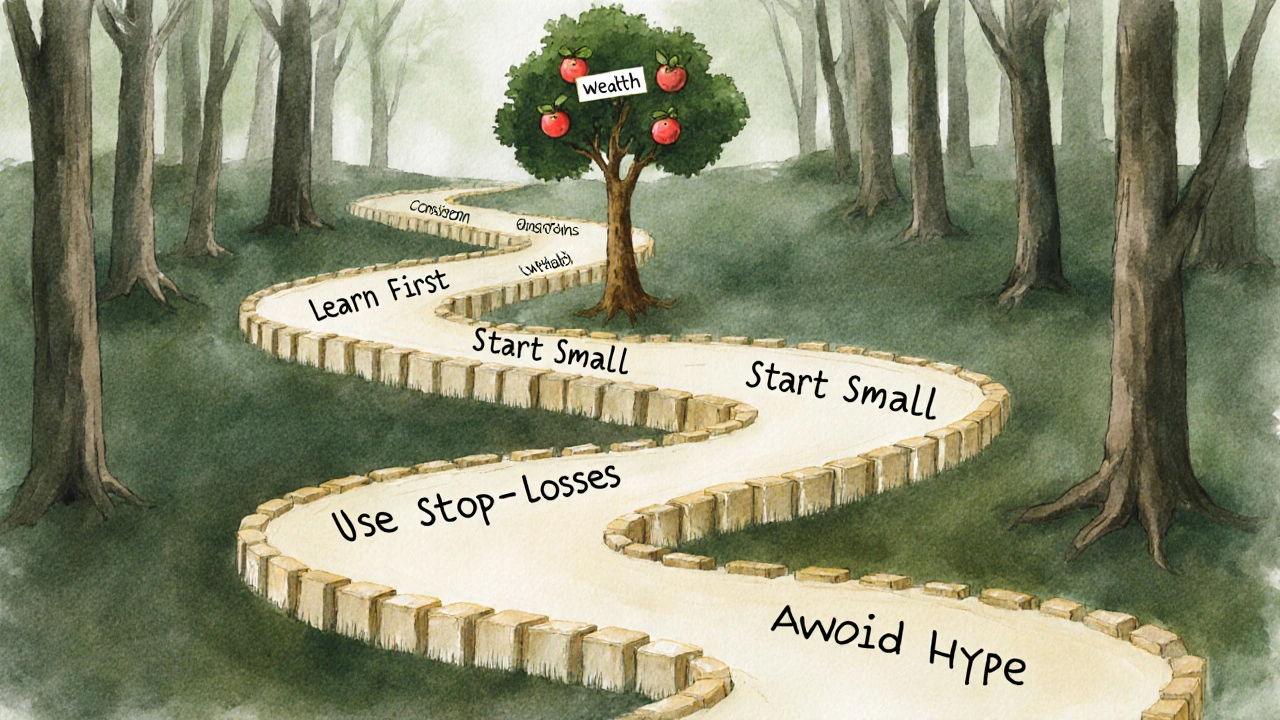

Where Do You Go From Here?

Start small. Learn slowly. Keep a journal. Avoid hype. Focus on what you can control: your discipline, your research, your risk limits.

Read one book: A Random Walk Down Wall Street by Burton Malkiel. It’s not flashy. It doesn’t promise riches. But it’s one of the most honest books on markets ever written.

Or watch one YouTube video: “How the Stock Market Works” by The Plain Bagel. It’s under 10 minutes. No fluff. Just facts.

Stock trading isn’t a lottery. It’s a skill. And like any skill, it takes time, patience, and repetition to get good at it.

Can you make a living from stock trading?

Yes, but it’s rare. Most people who make a full-time living from trading have spent years learning, lost money early on, and treat it like a business-not a hobby. They have a solid strategy, strict risk rules, and often trade with larger accounts ($50,000+). For most, trading is a side income, not a replacement for a job.

Is stock trading gambling?

Only if you’re guessing. If you’re making decisions based on company fundamentals, market trends, and risk management, it’s not gambling. If you’re buying a stock because your cousin said it’s going to explode, or you’re chasing a viral trend on Reddit-that’s gambling. The difference is preparation versus impulse.

Do I need to watch the market all day?

No. Day traders do. But if you’re swing trading or investing, checking your portfolio once a week is enough. Markets move slowly over time. Constant monitoring leads to stress and bad decisions. Set alerts for big price moves and focus on your plan.

What’s the best time to start trading?

The best time is now-with small amounts and a learning mindset. Waiting for the “perfect” market or more money is how people never start. You don’t need to know everything to begin. You just need to start doing, learning from mistakes, and adjusting.

Are there taxes on stock trading profits?

Yes. If you sell a stock for more than you paid, you owe capital gains tax. If you held it less than a year, it’s taxed as ordinary income. If you held it over a year, you pay a lower long-term rate. Brokers send you a 1099-B form each year with your trade details. Keep records.

Can you trade stocks with $100?

Yes. Many brokers let you buy fractional shares, so you can own part of a $500 stock with $100. But $100 is too little to build real wealth through trading alone. Use it to learn, not to get rich. Focus on practice, not profit, in the beginning.

Final Thought: It’s Not About Timing the Market

It’s about timing yourself.

Most people fail not because the market is too hard. They fail because they rush. They skip the learning. They ignore risk. They let emotions drive decisions.

Stock trading rewards patience, not speed. Discipline, not luck. Consistency, not big wins.

If you remember nothing else, remember this: the best trader isn’t the one who makes the most money in a week. It’s the one who still has money in their account five years later.

Janiss McCamish

November 23, 2025 AT 18:20I started with $200 and a Robinhood account. Bought one share of Apple just to see what it felt like. Didn't touch it for three months. It went up 12%. That’s all you need to know.

Richard H

November 24, 2025 AT 18:13Stop telling people to "just start small." Most of us aren’t in the US. You think $200 is nothing? Try living on minimum wage in rural Alabama and seeing what "small" means. This whole post is Wall Street propaganda wrapped in a hoodie.

Kendall Storey

November 25, 2025 AT 18:44Bro, you nailed it. Dollar-cost averaging is the only play that doesn’t make you want to quit your job and move to a cave. I’ve been doing it for 4 years with $150/month. Got 120 shares of VOO. No drama. No memes. Just compounding. And yeah, stop trading every time your cousin texts you a ticker. That’s not trading, that’s gambling with a spreadsheet.

King Medoo

November 27, 2025 AT 17:41Wow. Just... wow. 🤯 I’ve been trading since 2018 and I’ve lost $18k, but I’m still here. 💪 You’re right - the market doesn’t care about your feelings. But here’s the thing no one tells you: the real enemy isn’t FOMO. It’s your ex who said you’d never make it. Every time I see a red candle, I hear her voice. So I buy more. 🧠📉 I turned pain into profit. If you’re not crying while you trade, you’re not trying hard enough. 🥲

Rae Blackburn

November 28, 2025 AT 07:58They don’t want you to know this but Robinhood is owned by a hedge fund that profits off your trades. Every time you click buy they get paid. The whole system is rigged. The government knows. The Fed knows. Even your dog knows. You’re just a pawn in a game where the house always wins. And they call it "investing" 😏

LeVar Trotter

November 29, 2025 AT 11:04Let me break this down for the newbies: if you’re reading this and thinking "I need to beat the market," you’re already behind. The S&P 500 has returned ~10% annually for 90 years. That’s not sexy, but it’s how you retire. Stop chasing crypto influencers. Start reading SEC filings. Use Finviz. Track your trades. Your future self will high-five you. And no - you don’t need to watch the ticker all day. Your phone isn’t your therapist.

Tyler Durden

December 1, 2025 AT 00:29I used to trade every day. Lost everything. Then I started journaling. Every trade. Every emotion. Every mistake. I wrote "bought because scared" 17 times in one month. I stopped. Now I buy once a quarter. My portfolio’s up 87% since. The market doesn’t reward action. It rewards patience. And silence. And not checking your phone at 3 a.m. because you think the world’s ending. It’s not. You’re just anxious. Breathe. Then buy.

Aafreen Khan

December 2, 2025 AT 21:35lol u think this is real? i started with 500 rs and now i have 50k. how? i just followed the signals from my uncle in delhi. he says if u see red candle on 5 min chart u buy. if u see green u sell. no need to read books. no need to think. just trust the chart. and yes i made money. u just need to believe. 🤫💰

Pamela Watson

December 3, 2025 AT 06:21You’re all wrong. I made $12k in 3 weeks trading Tesla options. I didn’t even know what a moving average was. I just listened to the TikTok guy with the gold chain. He said "buy the dip" and I did. And guess what? I bought more when it dipped again. And again. Now I’m rich. You people overthink everything. Just trust the vibe. 🤙💸

michael T

December 4, 2025 AT 17:49They told me I was crazy for quitting my job to trade. They laughed. They said I’d end up homeless. I did. For three months. Then I turned $800 into $18k using meme stocks and pure rage. I cried in a Walmart parking lot eating ramen while watching my portfolio explode. Now I own a Tesla. And a yacht. And a dog named FOMO. This isn’t finance. It’s alchemy. You turn pain into profit. And if you don’t feel it in your bones? You’re not ready. 🔥💸

Christina Kooiman

December 6, 2025 AT 13:28I appreciate the intent behind this post, but there are several grammatical inconsistencies that undermine its credibility. For instance, the phrase "you don’t need a degree in finance or a six-figure salary to start" contains an unnecessary comma before "or," which is a classic error in compound predicates. Additionally, "$500/month trading platforms" lacks proper hyphenation-it should be "$500-per-month trading platforms." And please, for the love of Strunk & White, stop using "they’re" when you mean "their." This is a serious topic. It deserves precision. Not casual, sloppy writing that makes educated readers question whether the author even understands the basics of their own subject.