Most people think investing is about picking the next hot stock or timing the market. That’s not investing. That’s gambling with a spreadsheet. Real wealth grows slowly, quietly, and consistently-through systems, not luck. If you want to build lasting wealth, you need to master the art of investing, not chase quick wins.

What Investing Actually Is

Investing isn’t buying a crypto coin because a TikTok influencer said it’ll hit $10,000. It’s putting money to work so it earns more money over time. That’s it. The goal isn’t to get rich overnight. It’s to make your money work harder than you do.

Take the S&P 500. Since 1957, it’s returned about 10% annually on average-even after crashes, recessions, and pandemics. That’s not magic. That’s the power of owning a slice of the U.S. economy. When you invest in low-cost index funds tracking the S&P 500, you’re not betting on one company. You’re betting on innovation, productivity, and growth across 500 of the largest American businesses.

People who wait for the perfect moment to invest miss the point. Time in the market beats timing the market. A $500 monthly investment starting at age 25, earning 7% annually, becomes over $1.1 million by age 65. Start at 35? You end up with just $520,000. That’s a 53% difference from waiting ten years. Compound interest doesn’t care about your feelings. It rewards consistency.

Asset Allocation: Your Real Secret Weapon

Most beginners focus on which stocks to buy. Smart investors focus on how to split their money. That’s asset allocation-and it’s responsible for over 90% of your investment returns, according to a landmark 1986 study by Brinson, Hood, and Beebower.

Here’s how it works: You don’t put all your money in one place. You divide it among different types of assets-stocks, bonds, real estate, cash. Each behaves differently. Stocks grow fast but swing wildly. Bonds are slower but steadier. Real estate gives income and inflation protection.

A common rule for beginners: subtract your age from 110. That’s the percentage you put in stocks. The rest goes to bonds. So at 30, you’d have 80% stocks, 20% bonds. At 50, it’s 60% stocks, 40% bonds. This isn’t gospel, but it’s a simple starting point that reduces risk as you get older.

And don’t overcomplicate it. You don’t need 20 different funds. One total stock market fund, one total bond market fund, and maybe one international fund is enough. Vanguard’s VTSMX, BND, and VXUS are the workhorses of millions of portfolios. Low fees matter. A 1% fee on $100,000 costs you $1,000 a year. Over 30 years, that’s over $100,000 in lost growth.

Stop Trying to Beat the Market

Wall Street wants you to believe you can pick winning stocks. Financial advisors push actively managed funds with high fees. But the data doesn’t lie. Over 85% of actively managed U.S. mutual funds underperformed the S&P 500 over the last 15 years, according to S&P Dow Jones Indices.

Even professional investors can’t consistently beat the market. Warren Buffett, the richest investor alive, says most people should put their money in index funds. He’s not being humble. He’s being honest. The market is efficient. Information moves fast. By the time you hear about a “hot” stock, it’s already priced in.

Instead of chasing returns, focus on controlling costs, staying diversified, and staying invested. You don’t need to be a genius. You just need to be patient and disciplined.

Behavioral Mistakes That Kill Wealth

The biggest threat to your wealth isn’t inflation or taxes. It’s you.

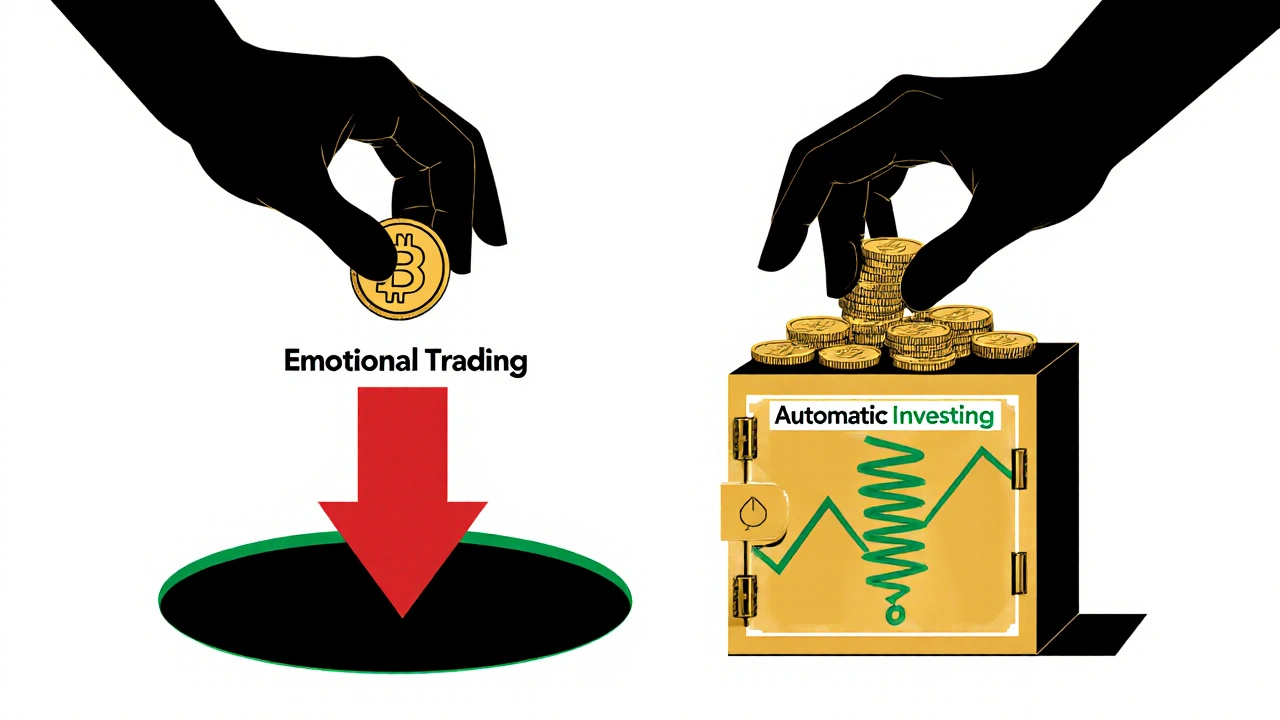

When the market drops 10%, 20%, or even 30%, panic sets in. You check your account. You see red numbers. You sell. Then you wait for the “right time” to get back in. But the market always recovers-and often faster than you think.

In 2020, the S&P 500 dropped 34% in one month because of the pandemic. By August, it was back to its pre-crash level. If you sold at the bottom, you missed the rebound. Most people do. A 2021 DALBAR study found the average investor earned just 3.8% annually over 20 years, while the S&P 500 returned 9.8%. The gap? Emotional decisions.

Here’s how to fix it:

- Set up automatic investments. Don’t think about it. Don’t check it daily.

- Ignore headlines. The news is designed to scare you or excite you. Neither helps your portfolio.

- Use a “sleep test.” If you can’t sleep knowing your portfolio dropped 20%, you’re too aggressive.

- Rebalance once a year. Sell what’s up, buy what’s down. It forces you to buy low and sell high-without emotion.

Where to Start: A Simple Roadmap

You don’t need a financial advisor. You don’t need a degree in finance. You just need to start.

Here’s your 5-step plan:

- Build a $1,000 emergency fund. Just enough to cover a flat tire or a small medical bill. Keep it in a high-yield savings account.

- Pay off high-interest debt. Credit cards at 20% interest eat your returns. Pay them off before investing.

- Open a brokerage account. Use Fidelity, Charles Schwab, or Vanguard. No minimums. No hidden fees.

- Invest $500 a month into a total stock market index fund. Set it to auto-invest on payday.

- Do nothing. For five years. Then ten. Then twenty.

That’s it. No complex strategies. No technical analysis. Just consistent action.

What Happens When You Stick With It

Let’s say you’re 30, earn $60,000 a year, and invest $500 a month ($6,000 a year). You earn 7% a year. In 10 years, you’ll have $88,000. In 20 years? $250,000. In 30 years? $650,000.

That’s not a lottery win. That’s compound growth. And it’s available to anyone who starts now, even with a little.

People think they need $10,000 to begin. They don’t. They need $50. Or $10. The key isn’t how much you start with. It’s whether you start at all.

And if you’re older? It’s not too late. A 45-year-old who starts investing $800 a month can still retire with over $500,000 by 65. That’s not life-changing money. But it’s enough to stop worrying.

Final Thought: Wealth Is a Habit

Investing isn’t about intelligence. It’s about behavior. It’s about showing up every month, even when the news is scary. It’s about ignoring the noise and trusting the math.

Millionaires don’t have secret formulas. They have routines. They invest before they spend. They don’t panic. They don’t chase trends. They just keep going.

You don’t need to be rich to start investing. You just need to be ready to begin.

Do I need a lot of money to start investing?

No. You can start with as little as $10. Many brokers let you buy fractional shares of ETFs or index funds. The key isn’t how much you start with-it’s that you start consistently. Investing $50 a month for 30 years at 7% returns gives you over $60,000.

Should I invest in individual stocks?

Only if you’re treating it like a side hobby, not your main strategy. Individual stocks are risky and time-consuming. Most people lose money trying to pick winners. If you want to invest in stocks, use low-cost index funds that own hundreds of them at once. That’s how professionals do it.

What’s the best investment for beginners?

A total stock market index fund like VTI or VTSMX. It holds thousands of U.S. companies in one low-fee fund. It’s diversified, simple, and historically returns about 7-10% a year. Pair it with a bond fund like BND for balance. That’s all you need.

How often should I check my investments?

Once a quarter at most. Checking daily leads to stress and bad decisions. If your portfolio drops, don’t sell. Rebalance once a year. If you’re contributing automatically, your money keeps working. Silence is your best tool.

Is real estate a better investment than stocks?

Not necessarily. Real estate can be great, but it’s less liquid, more hands-on, and comes with maintenance, taxes, and tenant issues. For most people, index funds are easier, cheaper, and more reliable. You can gain exposure to real estate through REIT funds like VNQ without owning property.

What should I do if the market crashes?

Keep investing. A crash is a buying opportunity, not a reason to panic. When prices fall, your regular contributions buy more shares at lower prices. This is called dollar-cost averaging. It smooths out volatility and rewards patience. Historically, markets always recover. The people who win are the ones who stay in.

Amy P

November 12, 2025 AT 17:04I just started investing $25 a month in VTI and it feels like I’m building a secret fortress of money while everyone else is chasing crypto memes. I’m 28, no debt, and I refuse to let fear or TikTok make my decisions for me. This post? Nailed it.

Mongezi Mkhwanazi

November 13, 2025 AT 00:15Let me be blunt: the entire premise of this post is naive. You assume everyone has access to low-fee brokerage accounts, stable income, and the psychological fortitude to ignore market swings. What about people in developing economies? What about those living paycheck-to-paycheck with no emergency fund? The ‘just start with $10’ advice is a luxury slogan for the privileged. Compound interest doesn’t care about your feelings? No-it doesn’t care about your survival either, if you’re one missed rent payment away from disaster.

Real wealth isn’t built by following Vanguard’s playlist. It’s built by systemic change, wage justice, and access to capital-which most of us don’t have. So yes, invest if you can. But don’t pretend this is a universal solution. It’s a comfort blanket for the comfortable.

Ashley Kuehnel

November 14, 2025 AT 19:46OMG YES to the auto-invest tip!! I used to check my portfolio every hour like it was a stock ticker at Times Square-total anxiety spiral. Then I set up $100 auto-deposits every payday and just… forgot about it. Three years later, I have over $40k and zero stress. Seriously, if you’re overthinking it, just automate. You don’t need to be a genius, just consistent. And yes, BND + VTSMX is all you need. No fancy funds. No crypto. Just boring, beautiful growth.

Colby Havard

November 15, 2025 AT 20:25It is, indeed, a profound and lamentable truth that the majority of individuals, seduced by the siren song of speculative frenzy, have abandoned the foundational principles of prudent capital allocation. The notion that one may achieve financial sovereignty through passive indexation is not merely correct-it is axiomatic. Yet, I find it curious that the author neglects to address the erosion of purchasing power due to monetary debasement; the Federal Reserve’s balance sheet expansion has, in fact, rendered nominal returns deceptive. One must, therefore, augment one’s portfolio with tangible assets-gold, land, or even Bitcoin-as a hedge against systemic decay. The S&P 500 is not a panacea; it is a fragile artifact of a fragile system.

adam smith

November 16, 2025 AT 11:53Yeah. Invest. Good stuff. I did it. Got rich. Not really. But I feel better. Thanks.

Fredda Freyer

November 17, 2025 AT 09:16There’s a quiet power in consistency that no algorithm can replicate. Most people think wealth is a destination-something you arrive at after a big win. But it’s not. It’s a daily practice. It’s choosing to invest $50 instead of spending it on a new pair of shoes you don’t need. It’s not checking your balance after every market dip. It’s sleeping while the market works. I started at 32 with $200 a month. I’m 42 now. I’m not rich by billionaire standards-but I’m free. I don’t dread Mondays. I don’t panic when the news says ‘recession.’ I just keep going. That’s the real secret. Not the fund. Not the asset allocation. The habit. The stubborn, boring, daily commitment to your future self.

And if you’re thinking, ‘I’m too old,’-you’re not. My neighbor started at 58. He’s 63 now. He has $180k. He didn’t win the lottery. He just didn’t quit.

Don’t wait for perfect. Wait for now.

Kelley Nelson

November 17, 2025 AT 22:11How quaint. One assumes that the average individual possesses the cognitive capacity to comprehend the nuances of asset allocation, the financial literacy to discern between ETFs and mutual funds, and the psychological resilience to withstand the volatility of a capitalist system that systematically favors those already endowed with capital. One also assumes, apparently, that access to a brokerage account is equivalent to access to opportunity. How utterly, devastatingly, middle-class this narrative is. The real question isn’t whether one should invest in index funds-it’s whether one is permitted to participate in the system at all.

Gareth Hobbs

November 19, 2025 AT 15:04Index funds? Please. The whole thing’s rigged. The Fed prints money, banks get bailed out, and little guys are told to buy VTI like it’s some holy sacrament. Meanwhile, the top 1% own 80% of stocks. You think your $500/month is gonna change that? You’re just funding the machine that’s crushing you. And don’t get me started on Vanguard-they’re owned by BlackRock, which is owned by the same shadowy cabal that runs the Fed. Wake up. The system doesn’t want you to win. It wants you to think you can-and keep feeding it.

Mark Nitka

November 20, 2025 AT 00:05Look, I get why people get emotional about this stuff. But Mongezi and Gareth? You’re both right in different ways. Yes, the system is stacked. Yes, wealth inequality is real. But that doesn’t mean we throw our hands up. I grew up poor. My mom worked two jobs. I started investing at 21 with $10 a week. I didn’t ‘beat the system’-I just played it smarter than most. I didn’t buy crypto. I didn’t chase trends. I just showed up. And now I’m not rich-but I’m not scared either. The goal isn’t to overthrow capitalism. It’s to not let it own you. So yes-start small. Stay calm. Keep going. That’s how you win.

Zelda Breach

November 21, 2025 AT 03:08Wow. Another self-congratulatory piece of financial propaganda. Did you really just say ‘you don’t need a degree in finance’ like that’s some kind of virtue? Meanwhile, the average person doesn’t even know what an expense ratio is. This post reads like a Bloomberg ad written by someone who’s never had to choose between rent and groceries. And don’t get me started on ‘dollar-cost averaging’-it’s just a fancy term for ‘hope you don’t get fired next month.’

Alan Crierie

November 22, 2025 AT 16:15Love this post! 🙌 Just wanted to add-don’t forget about tax-advantaged accounts! If you’re in the US, max out your 401(k) or IRA first before a regular brokerage. The tax benefits are huge. Also, if you’re feeling overwhelmed, start with just one fund-VTI is perfect. And yeah, check your balance once a quarter. I used to check daily… now I only look when I’m adding money. Life’s so much calmer. 💪

Aryan Gupta

November 23, 2025 AT 05:29Everyone here is missing the real point. The S&P 500 is manipulated by algorithmic trading and insider collusion. The 10% average return? A myth. It’s calculated using survivorship bias-companies that failed are erased from the index. And who controls the index? BlackRock, State Street, Vanguard-all owned by the same financial oligarchs who profit from your compliance. You think you’re investing? You’re just lending your money to the very system that’s destroying your future. And if you think dollar-cost averaging helps, you’re being played. They want you to keep buying when prices are low-so they can dump their overvalued positions on you. Wake up. The market isn’t a game. It’s a prison with a return button.

Colby Havard

November 24, 2025 AT 15:02It is, however, worth noting that the notion of ‘dollar-cost averaging’-while superficially appealing-is merely a behavioral crutch for those who lack the discipline to accumulate capital in lump sums. The true investor does not wait for periodic paychecks to deploy capital; they accumulate, analyze, and act decisively when valuation dislocations present themselves. To treat investing as a monthly subscription service is to confuse diligence with inertia.