Most people think financial success means making more money. But that’s not the real issue. The real issue is keeping it, growing it, and letting it work for you while you sleep. That’s where investments come in. Without them, even a six-figure salary can vanish in a few years. With them, a modest income can build real wealth over time.

Why Investments Are Not Optional

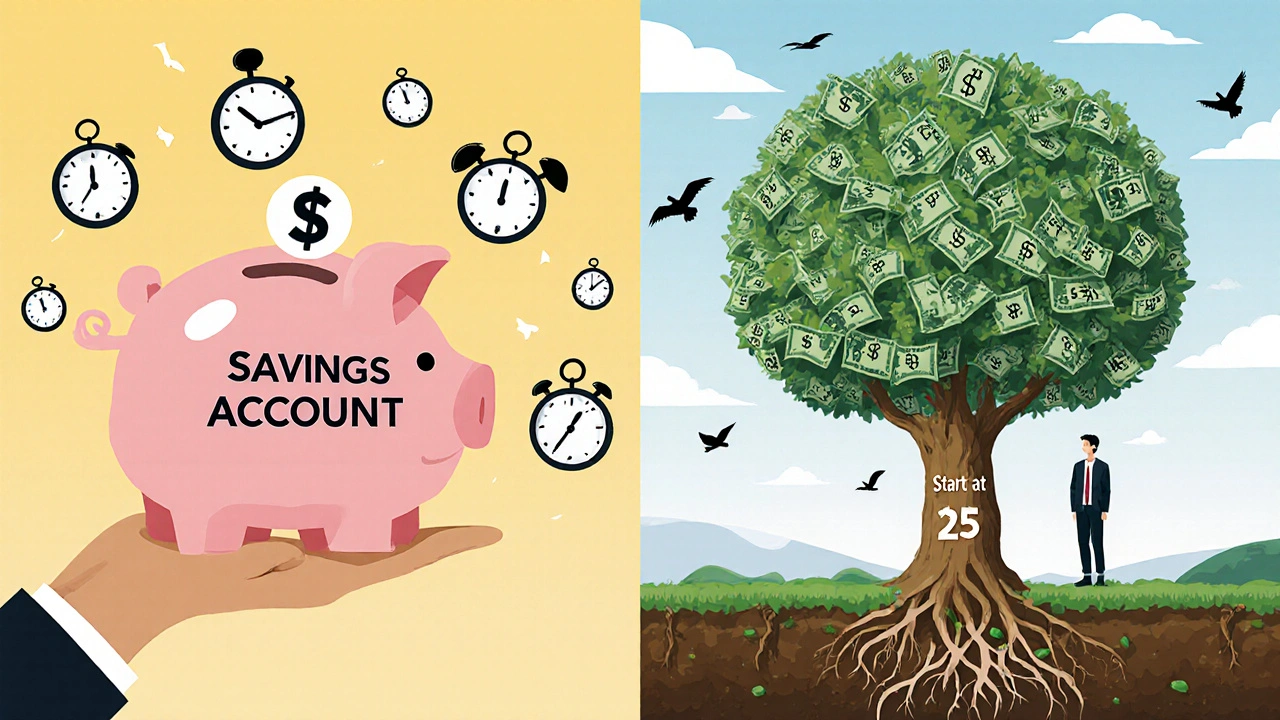

Let’s say you make $60,000 a year. You save $10,000 every year and keep it in a savings account earning 0.5% interest. After 30 years, you’ll have $300,000 in deposits plus about $5,000 in interest. Not bad-but not life-changing.

Now, let’s say you invest that same $10,000 a year into a low-cost index fund that averages 7% annual returns. After 30 years, you’ll have over $1 million. That’s not magic. That’s compound growth. The difference isn’t how much you earn-it’s what you do with it.

People who wait to invest until they’re “ready” or until they have a big bonus are losing time. Time is the most powerful tool in investing. Starting at 25 instead of 35 can double your final balance-even if you invest the same total amount.

What Kind of Investments Actually Work?

There are thousands of investment options. But only a few consistently deliver real results for regular people.

- Index funds-These track the whole stock market, like the S&P 500. They cost less than 0.1% in fees and have returned about 10% annually over the last 90 years. Vanguard and Fidelity offer them with no minimums.

- Real estate investment trusts (REITs)-You don’t need to buy a building. REITs let you own a slice of malls, apartments, or warehouses. They pay regular dividends and have historically returned 8-10% per year.

- Employer-sponsored retirement plans-If your job offers a 401(k) with matching contributions, that’s free money. Contribute at least enough to get the full match. It’s a 100% return on your money right away.

- High-yield savings accounts-Not an investment per se, but a smart place to keep your emergency fund. Right now, rates are around 4.5%, which beats inflation and keeps your cash safe.

Stay away from crypto, penny stocks, and get-rich-quick schemes. They’re gambling, not investing. The odds are stacked against you. The stock market doesn’t care if you’re lucky. It rewards patience and consistency.

How to Start Without Knowing Everything

You don’t need a finance degree to begin. You just need to take one step.

- Open a brokerage account with Fidelity, Vanguard, or Charles Schwab. All three have zero fees and no minimum deposits.

- Set up an automatic transfer of $50 or $100 every payday into a low-cost S&P 500 index fund.

- Let it sit. Don’t check it daily. Don’t panic when the market drops. History shows markets recover-and then rise higher.

- Every year, increase your contribution by 1-2%. Even a small raise adds up.

That’s it. You’ve started investing. You don’t need to pick stocks. You don’t need to time the market. You just need to show up, regularly, for years.

The Hidden Cost of Not Investing

Not investing isn’t safe. It’s expensive.

Inflation averages 3% per year. That means your money loses half its buying power every 24 years. If you keep cash under your mattress, you’re losing 3% every year. That’s a hidden tax you can’t avoid.

And it’s not just about money. It’s about freedom. People who invest build options. They can leave jobs they hate. They can take time off. They can retire early. They can help family without going into debt.

One client I worked with in Chicago paid off her credit cards and started investing $200 a month at age 32. At 47, she quit her corporate job to start a small bakery. She didn’t have millions-but she had enough. That’s the power of consistent investing.

Common Mistakes That Kill Wealth

People don’t fail because they don’t know enough. They fail because they do the wrong things.

- Waiting for the perfect moment-There is no perfect time. The best time to start was 10 years ago. The second best is today.

- Chasing hot stocks-Tesla, Nvidia, Bitcoin-they all spike and crash. Trying to ride the wave usually ends in losses.

- Ignoring fees-A 1% annual fee on a $100,000 portfolio costs you $1,000 a year. Over 30 years, that’s over $100,000 in lost growth.

- Not diversifying-Putting all your money in one stock or one sector is like betting your entire paycheck on one horse.

- Emotional trading-Selling during a crash because you’re scared? That locks in your losses. Buying because everyone’s talking about it? That’s buying high.

The market doesn’t reward the smartest person. It rewards the calmest person.

What Success Looks Like in Real Life

Financial success isn’t a Lamborghini or a private jet. It’s peace of mind.

It’s knowing you can cover your rent if you lose your job. It’s being able to pay for your kid’s college without loans. It’s having enough to travel, help your parents, or start a side business.

One man I know in Chicago started investing $75 a month at 22. He worked as a barista. He didn’t have a high salary. But he never missed a contribution. At 45, he retired. He didn’t move to Florida. He just stopped working full-time. He now runs a woodworking shop on weekends and lives on his investment income.

That’s not luck. That’s compound growth. That’s discipline. That’s the key.

Where to Go From Here

Start small. Stay consistent. Ignore the noise.

Set up that automatic transfer. Pick one fund. Let it grow. Revisit your progress once a year-not every week. Read one book if you want: The Simple Path to Wealth by JL Collins. It’s short, clear, and free of fluff.

You don’t need to be rich to start investing. You just need to start.

Do I need a lot of money to start investing?

No. You can start with as little as $50. Many brokers let you buy fractional shares, so you can invest in top companies like Apple or Amazon even if you can’t afford a full share. The key isn’t how much you start with-it’s how consistently you add to it over time.

Is investing in the stock market risky?

All investing carries risk, but the risk isn’t in the market-it’s in your behavior. If you buy and hold low-cost index funds for 10+ years, you’ve historically had a 95% chance of making money. The real danger is selling when prices drop or jumping into trends without understanding them.

Should I invest in real estate or stocks?

Both can work, but stocks are easier for most people. Real estate requires more hands-on management, bigger upfront costs, and more maintenance. REITs give you stock market exposure to real estate without the headaches. Start with stocks, then consider real estate later if you want more diversification.

How do I know if I’m on track for financial success?

A simple rule: by age 30, aim to have saved one times your annual salary. By 40, three times. By 50, six times. If you’re investing 10-15% of your income every year into a diversified portfolio, you’re likely on track. If you’re not, adjust your budget-not your goals.

What’s the best investment for beginners?

A low-cost S&P 500 index fund. It gives you exposure to 500 of the largest U.S. companies in one simple purchase. It’s diversified, low-cost, and historically delivers strong returns. Vanguard’s VOO or Fidelity’s FUSEX are great options. Just set up automatic contributions and forget about it.