Everyone wants to make money from investments. But if you skip the part about risk, you’re not investing-you’re gambling. The truth is, there’s no such thing as a risk-free return. Even the safest options come with trade-offs. Understanding risk versus reward isn’t just a finance class topic-it’s the core skill that separates people who grow wealth from those who lose it.

What Risk Really Means in Investing

Risk isn’t just about losing money. It’s about uncertainty. It’s the chance that your investment won’t perform the way you expected. That could mean losing part of your cash, not keeping up with inflation, or missing out on better opportunities elsewhere.

Take a savings account. It feels safe. But if inflation is 3% and your account pays 0.5%, you’re losing 2.5% every year in buying power. That’s a hidden risk. On the other end, buying a single stock like Tesla might swing 15% in a day. That’s volatility-and it’s a different kind of risk.

Real risk is about whether your money does what you need it to do. Need to buy a house in three years? Then you can’t afford to put that money in crypto. Need to retire in 20 years? Then sitting in cash might be the riskiest move of all.

How Reward Is Measured

Reward isn’t just the percentage your investment goes up. It’s the total gain after fees, taxes, and time. A stock that returns 20% in a year sounds great-until you realize you paid 2% in trading fees and lost 5% to capital gains tax. Net reward? 13%.

Historical returns help set expectations. The S&P 500 has averaged about 10% annual returns over the last 90 years, including dividends. But that’s an average. Some years it’s up 30%. Others, it’s down 20%. The key is long-term compounding, not chasing one big win.

Real estate might pay 6% in rental income and another 4% in appreciation. Bonds might pay 3% with little movement. Each has a different reward structure. You’re not just comparing numbers-you’re comparing how those numbers behave over time.

The Risk-Reward Spectrum

Not all investments sit at the same point on the risk-reward scale. Here’s how common options stack up:

| Investment Type | Average Annual Return (Historical) | Risk Level | Best For |

|---|---|---|---|

| Savings Accounts | 0.5% - 1% | Very Low | Emergency funds, short-term goals |

| Government Bonds (10-year U.S. Treasuries) | 3% - 4% | Low | Stable income, conservative investors |

| Corporate Bonds | 4% - 6% | Low to Medium | Income seekers with moderate risk tolerance |

| Index Funds (S&P 500) | 8% - 10% | Medium | Long-term growth, retirement accounts |

| Individual Stocks | Varies widely (5% - 20%+) | Medium to High | Investors who research and monitor |

| Cryptocurrencies | Highly volatile (can be -50% to +300% in a year) | Very High | Speculators with high risk tolerance |

| Real Estate (Rental) | 6% - 10% (income + appreciation) | Medium | Long-term investors who can manage property |

Notice something? Higher returns almost always come with more uncertainty. And that’s okay-if you know what you’re signing up for.

Why People Get Risk Wrong

Most investors don’t fail because they pick bad stocks. They fail because they misunderstand their own risk tolerance.

Think about 2022. The S&P 500 dropped 19%. Many people who said they were "comfortable with risk" panicked and sold. They locked in losses. Why? Because they never tested their tolerance under real pressure. They thought risk meant "the possibility of loss," not "the emotional cost of watching your portfolio drop."

Another mistake? Chasing past performance. A crypto coin that went up 500% last year? Doesn’t mean it will do it again. Past returns don’t predict future results-but they do make people feel invincible.

And then there’s the illusion of safety. People think their home is a "safe" investment. But homes don’t pay dividends. They cost money to maintain, insure, and tax. If you need to sell fast, you might lose 10% in fees and timing. That’s not risk-free-it’s illiquid.

How to Match Risk to Your Goals

There’s no universal "right" risk level. It depends on three things: your time horizon, your financial goals, and your emotional comfort.

- Short-term goals (under 3 years): Stick to low-risk options. Savings accounts, CDs, or short-term bonds. Don’t gamble money you’ll need soon.

- Medium-term goals (3-10 years): A mix of bonds and index funds. You can handle some ups and downs, but you still need stability.

- Long-term goals (10+ years): You can afford more risk. Stocks and real estate have time to recover from downturns. The longer your timeline, the more you benefit from compounding-even with volatility.

Also, ask yourself: What’s the worst-case scenario? If your portfolio drops 30%, can you sleep at night? If the answer is no, then you’re holding too much risk. Adjust your holdings before a crash hits.

Building a Balanced Portfolio

You don’t have to choose between safe and risky. You build a portfolio that balances both.

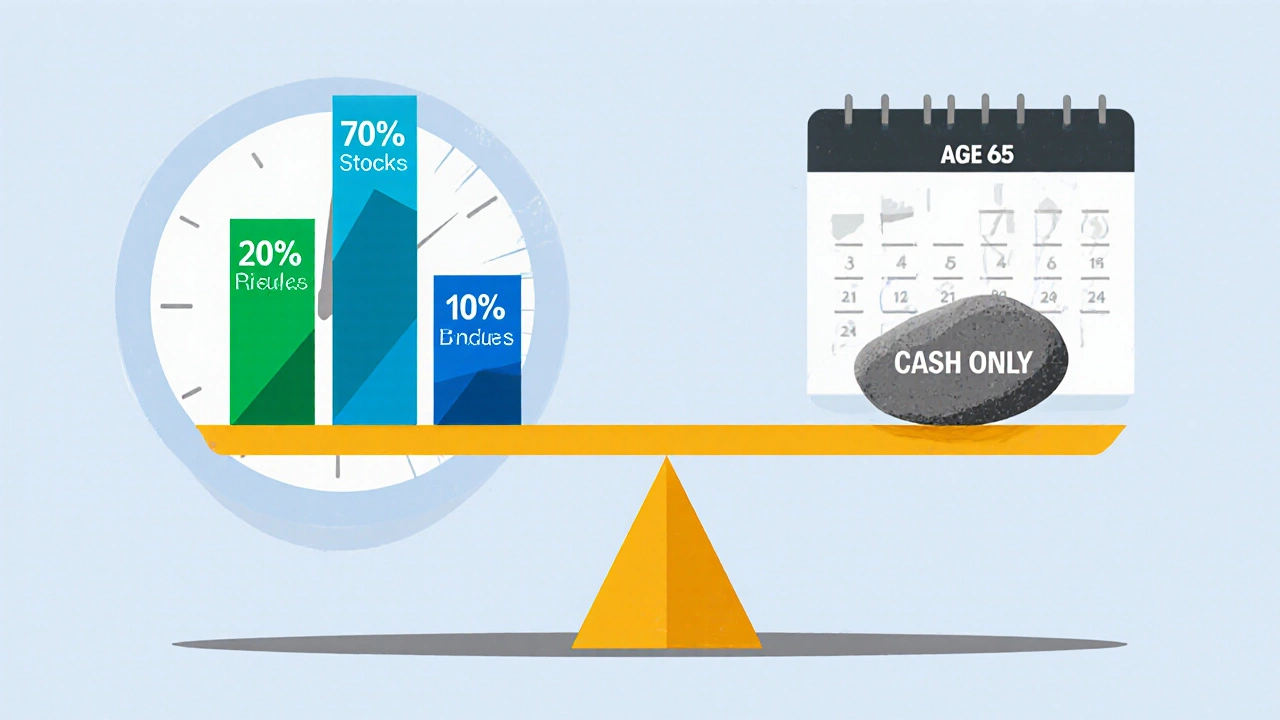

For example: A 35-year-old saving for retirement might put 70% in a low-cost S&P 500 index fund, 20% in international stocks, and 10% in bonds. That’s not reckless. It’s strategic. The stocks drive growth. The bonds reduce swings.

As you get older, you shift. At 50, maybe it’s 50% stocks, 40% bonds, 10% real estate. At 65, it could be 30% stocks, 60% bonds, 10% cash. That’s not giving up. It’s protecting what you’ve built.

Rebalancing once a year keeps you on track. If stocks surge and now make up 80% of your portfolio instead of 70%, sell a little and buy bonds. You’re locking in gains and reducing risk automatically.

The Hidden Cost of Avoiding Risk

Playing it too safe can be the most dangerous move of all.

Imagine two people. One puts $10,000 in a savings account earning 1% a year. The other invests the same amount in an index fund averaging 8%. After 30 years, the saver has $13,478. The investor has $100,627. That’s nearly eight times more.

That gap isn’t luck. It’s the power of compounding-and the cost of avoiding risk. Inflation eats away at cash. Over 30 years, $10,000 in 1995 would need $22,000 today to have the same buying power. Savings accounts don’t keep up.

People who avoid all risk often end up with less money, not more. They trade short-term comfort for long-term regret.

When to Take More Risk

There are times when higher risk makes sense:

- You’re young and have decades to recover from losses.

- You have a stable job and emergency fund-so a market dip won’t hurt your daily life.

- You’ve done your homework on a specific asset and understand its risks.

- You’re investing money you won’t need for at least 10 years.

But never risk money you can’t afford to lose. That includes rent money, medical savings, or funds you’re counting on for a child’s education.

Final Rule: Risk Is a Tool, Not a Threat

You can’t eliminate risk. You can only manage it. The goal isn’t to avoid risk-it’s to take the right amount for your situation.

Understand your goals. Know your timeline. Build a portfolio that matches your life-not someone else’s hype. And never forget: the best investment isn’t the one with the highest return. It’s the one you can stick with when things get scary.

Is it possible to have high reward with low risk?

No, not consistently. High returns almost always come with higher risk. If something promises big gains with no risk, it’s either a scam or a misunderstanding. The market rewards people who take calculated risks, not those who chase fantasy returns. The closest thing to low-risk, high-reward is long-term investing in diversified index funds-but even those have ups and downs.

How much risk should I take if I’m 50 years old?

At 50, you’re likely in the accumulation or early retirement phase. A common rule is to subtract your age from 110 or 120 to get your stock allocation. That means 60-70% in stocks, 30-40% in bonds and cash. But it depends on your goals. If you plan to retire at 65 and have a solid pension or savings, you can afford more risk. If you’re relying solely on your portfolio, lean more conservative. The key is balancing growth with protection.

What’s the biggest mistake people make with risk?

They confuse volatility with permanent loss. A 20% drop in your portfolio isn’t a loss unless you sell. Many people panic during market dips and sell at the bottom-locking in losses. Others chase hot trends after they’ve already run up. The real mistake isn’t taking risk-it’s letting emotions drive decisions.

Are bonds really safer than stocks?

Generally, yes-but not always. Government bonds like U.S. Treasuries are among the safest assets because the U.S. government has never defaulted. Corporate bonds carry more risk, especially if the company is struggling. Bonds can lose value if interest rates rise, and inflation can eat into returns. Stocks are more volatile, but over 20+ years, they’ve outperformed bonds by a wide margin. The safety depends on what kind of bond and your time frame.

Should I invest in crypto for higher returns?

Only if you’re prepared to lose it all. Crypto can deliver huge returns, but it’s also the most volatile asset class available. A single tweet or regulatory change can wipe out 50% of your investment overnight. It’s not an investment-it’s speculation. If you want to include it, limit it to 1-5% of your portfolio. Never use money you need for living expenses or emergencies.

What to Do Next

Start by writing down your goals. When do you need the money? What’s it for? Then list your current investments and their risk levels. Compare them to your goals. If you’re saving for a house in two years and your money’s in stocks, adjust. If you’re 30 and your portfolio is 90% cash, you’re falling behind.

Rebalance once a year. Reassess every five years. And remember: the goal isn’t to win every year. It’s to stay in the game long enough for compounding to do its work.

Kenny Stockman

November 3, 2025 AT 19:13Man, I wish someone told me this when I was 22 and putting all my cash into Dogecoin because a Reddit post said it’d hit $10. 😅

Paritosh Bhagat

November 4, 2025 AT 09:48Let me just say, if you're still holding cash under your mattress thinking it's 'safe,' you're not being smart-you're being delusional. Inflation isn't a suggestion, it's a thief in a suit. And no, your 0.5% savings account isn't protecting you-it's just letting the bank profit off your naivety. 🤦♂️

Adrienne Temple

November 5, 2025 AT 18:42My mom always said, 'Don't put all your eggs in one basket'-but I didn't get it until I saw my 401(k) drop 30% in 2022. I panicked and almost sold... then remembered I'm 32 and have time. Now I just laugh at the daily swings. 🙃

Nick Rios

November 7, 2025 AT 02:09It's wild how many people think risk is bad. It's not. Risk is just information you haven't learned how to read yet. The real danger is pretending you don't have any.

Amanda Harkins

November 8, 2025 AT 05:55I used to think bonds were boring. Then I realized they're the quiet friend who shows up when everyone else ghosts you. 🤝

Antonio Hunter

November 8, 2025 AT 21:05One thing people rarely talk about is how emotional risk management is actually more important than financial math. I’ve seen brilliant analysts lose everything because they couldn’t handle seeing their portfolio down 15% on a Tuesday morning. The numbers don’t lie-but your cortisol levels? Those tell a much louder story. You can have the perfect asset allocation, but if you sell when the market dips because you feel like you’re failing, then your strategy is just paper. Real investing is about consistency through discomfort, not perfection through avoidance.

Chris Heffron

November 10, 2025 AT 06:17Love the table! But just a tiny note-U.S. Treasuries aren’t *completely* risk-free if you’re not holding to maturity. Interest rate risk is real, especially with long-term bonds. Just saying 😊

Ben De Keersmaecker

November 11, 2025 AT 15:59It’s funny how people equate 'low risk' with 'no risk.' But risk isn’t binary. It’s a spectrum of trade-offs: liquidity, inflation, volatility, opportunity cost. Even putting money in a mattress has risk-it’s called 'opportunity cost plus theft.' The real skill isn’t picking the 'safest' option-it’s understanding which trade-offs you’re willing to live with.

Sandy Dog

November 11, 2025 AT 20:16Okay but imagine this: you’re 65, your portfolio’s been humming along, you’re sipping tea, thinking you’re golden… then the market crashes and your 'safe' bonds get hit by inflation AND rising rates and your 'conservative' plan turns into a horror movie. 😱 I’m not saying don’t be conservative-I’m saying don’t be *blindly* conservative. I cried when my 401(k) dropped in 2022. I’m not proud. But I learned. And now I rebalance like it’s my job. Because it kinda is.

Kenny Stockman

November 11, 2025 AT 21:12@Chris Heffron-good catch on the maturity point. I used to think bonds were just 'safe' until I got burned by a 10-year Treasury that lost value when rates spiked. Never assume safety without checking the fine print. Thanks for keeping us honest 😎