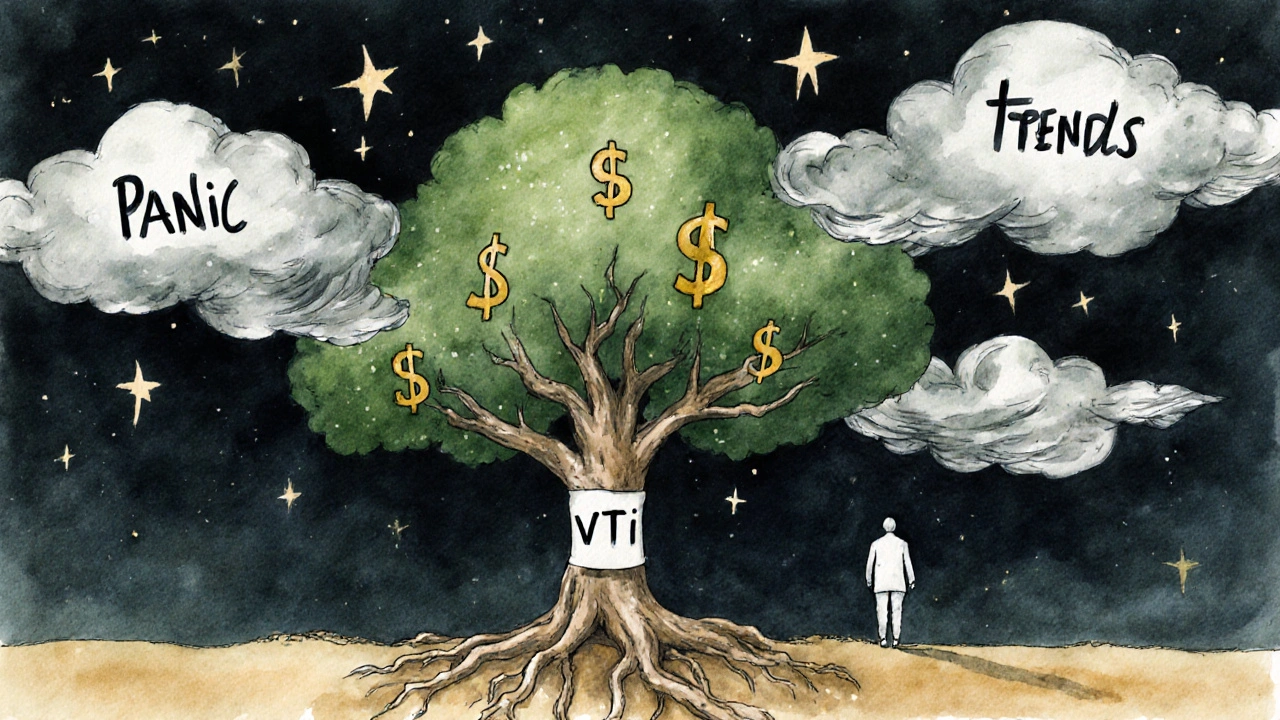

Most people think profitable investments are about picking the next hot stock or timing the market. That’s not true. The real art isn’t in guessing what will go up tomorrow-it’s in building a system that works no matter what the headlines say. If you’ve ever watched your portfolio drop 20% and panicked, or chased a trend only to lose money, you already know the problem. The solution isn’t more research. It’s better structure.

Profitable investments start with patience, not predictions

Warren Buffett didn’t become rich by buying stocks that were trending on Reddit. He bought businesses he understood and held them for decades. The S&P 500 returned about 10% annually from 1957 to 2024. That’s not magic. That’s compounding. But only if you stayed in. Investors who bailed during the 2008 crash or the 2020 pandemic drop missed the biggest recoveries in history. Missing just the 10 best days in the last 20 years cuts your returns by nearly half. Profitable investing isn’t about catching every upswing. It’s about avoiding the big drops-and staying invested through them.

Asset allocation is your real edge

Studies from Vanguard and Morningstar show that over 90% of portfolio performance comes from how you split your money between asset classes-not which stocks or funds you pick. That means if you put 70% in stocks, 20% in bonds, and 10% in cash, your returns will be shaped far more by that split than by whether you chose Apple or Microsoft. A simple portfolio like this has outperformed most actively managed funds over 15+ years. You don’t need to be a genius. You need to be consistent. Rebalance once a year. If your stocks grow too big, sell a little and buy more bonds. If bonds drop, use that chance to buy more stocks at lower prices. This isn’t trading. It’s maintenance.

Low-cost index funds beat most professionals

Over the last decade, more than 80% of actively managed U.S. stock funds underperformed the S&P 500. Why? Fees. A fund charging 1% a year eats away 10% of your returns over 10 years. A low-cost index fund might charge 0.05%. That’s 20 times cheaper. You don’t need a financial advisor to pick winners. You need a brokerage account and a few ETFs: VTI for U.S. stocks, VXUS for international, and BND for bonds. These cover nearly every publicly traded company in the world. They cost less than $5 to trade. You can set it up in 15 minutes and forget it for years.

Stop chasing returns. Start managing risk.

People think risk means losing money. But the real risk is not having enough when you need it. That’s why a 30-year-old investing for retirement can handle 90% stocks. A 60-year-old nearing retirement needs bonds to cover living expenses for the next 10-15 years. If you sell stocks during a crash to pay bills, you lock in losses. That’s the quiet killer of wealth. Build an emergency fund first-six months of expenses in cash or short-term bonds. Then invest the rest. Your portfolio should protect your lifestyle, not gamble on it.

Behavior is your biggest obstacle

The market doesn’t make you poor. Your emotions do. You see a stock double in six months and buy in-only to watch it crash. You hear a friend made money on crypto and jump in at the top. You panic-sell when the news says inflation is rising. These aren’t mistakes. They’re human. The fix isn’t more knowledge. It’s rules. Write down your plan: “I invest $500 a month in VTI and VXUS. I never touch it for 10 years. I rebalance once a year.” Stick to it. Use automatic transfers. Set reminders. Make it mechanical. The market doesn’t care if you’re scared. It only cares if you’re still in.

Real examples: What profitable investing looks like in practice

Take Maria, 35, from Chicago. She makes $65,000 a year. She puts $300 a month into a Roth IRA with VTI and VXUS. She doesn’t check it monthly. She doesn’t trade. In 2023, her account was worth $28,000. In 2025, it’s $42,000. She didn’t get lucky. She just kept going. Now she’s adding $50 a month to a taxable brokerage with BND for balance. She’s not rich. But she’s on track.

Compare that to Jamal, 38. He read about AI stocks in 2021. He put $15,000 into NVIDIA and Tesla. By 2023, half his money was gone. He sold. Then bought gold. Then tried crypto. He’s still trying to break even. He’s not lazy. He’s confused. He chased returns instead of building a system.

What to avoid at all costs

- Buying stocks based on TikTok trends or YouTube gurus

- Investing money you’ll need in the next 3-5 years

- Paying high fees for mutual funds or managed accounts

- Trying to time the market or predict recessions

- Using leverage (borrowed money) to invest

These aren’t just bad ideas. They’re wealth destroyers. The average investor loses 1.5% a year to poor timing alone. That’s $15,000 over 20 years on a $50,000 portfolio. You don’t need to be smart. You need to be steady.

Start simple. Stay consistent.

You don’t need a degree in finance. You don’t need a fancy app. You need three things: a brokerage account, a plan, and the discipline to follow it. Open an account with Fidelity, Vanguard, or Charles Schwab. Set up automatic deposits of $100 or $500 a month. Pick two or three low-cost index funds. Let them grow. Ignore the noise. Check your balance once a quarter. Rebalance once a year. That’s it. The compound effect will do the rest. Over 30 years, investing $500 a month at 8% annual returns turns into over $750,000. That’s not a dream. That’s math.

Profitable investing isn’t about being right all the time. It’s about being there, consistently, when the market recovers. And it always does.

What’s the safest way to start investing with little money?

Start with a low-cost index fund like VTI or VOO through a brokerage like Vanguard or Fidelity. You can begin with as little as $10. Set up automatic monthly deposits-even $50 a month builds up over time. Focus on consistency, not the amount. Avoid high-fee products and individual stocks until you’re comfortable with how markets work.

How often should I check my investment portfolio?

Check your portfolio once every three months at most. Daily or weekly checks lead to emotional decisions. The market moves every day, but your goals don’t. Rebalance once a year to keep your asset allocation on track. If you’re investing for retirement, you shouldn’t be watching daily swings-just making sure your deposits keep coming.

Should I invest in individual stocks or stick to index funds?

For most people, index funds are the better choice. Individual stocks carry higher risk and require deep research. Even professional investors struggle to beat the market consistently. Index funds give you instant diversification across hundreds or thousands of companies. They’re cheaper, simpler, and historically more reliable. Save individual stock picking for a small portion of your portfolio-no more than 10%-if you want to experiment.

Is real estate a better investment than stocks?

Real estate can be profitable, but it’s not easier or safer than stocks. It requires more hands-on work, upfront capital, and ongoing maintenance. Stocks through index funds give you exposure to real estate companies (like REITs) without owning property. For most people, stocks are more liquid, less stressful, and more scalable. Real estate works for some, but it’s not a magic bullet.

What if the market crashes again? Should I sell?

No. Selling during a crash locks in your losses. Historically, markets recover. The S&P 500 bounced back after every major crash since 1929. If you’re investing for the long term, a crash is an opportunity to buy more at lower prices. Keep contributing regularly. That’s called dollar-cost averaging. It smooths out volatility and builds wealth over time.

How much should I have saved before I start investing?

Before investing, have at least three to six months of living expenses saved in a high-yield savings account. This is your safety net. If you lose your job or face an emergency, you won’t need to sell investments at a loss. Once that’s in place, start investing what you can-$50, $100, or more-every month. Investing and saving aren’t either/or. They’re both necessary.

If you’re reading this and thinking, “I’m too late,” you’re not. The best time to start was 10 years ago. The second-best time is today. Start small. Stay steady. Let time and compounding do the heavy lifting.

Bob Buthune

November 10, 2025 AT 07:38I get it, man. I really do. I used to check my portfolio every damn hour like it was a stock ticker at Times Square. Then one night, after my third panic sell in two years, I just... stopped. I set up auto-deposits, forgot about it, and started sleeping again. Now I look at it once a quarter. It’s not exciting. But it’s mine. And it’s growing. No drama. No FOMO. Just quiet compounding. I don’t even know what VTI stands for, but I know it’s in my account. 📈💤

Jane San Miguel

November 11, 2025 AT 14:56How refreshing to encounter a piece of financial advice that doesn’t rely on the intellectual bankruptcy of TikTok finance gurus. The author’s emphasis on asset allocation as the primary determinant of returns is not merely correct-it is empirically irrefutable. Vanguard’s seminal research on this topic, published in 2010, remains foundational. One must also acknowledge the pernicious effect of expense ratios: a 1% fee over 30 years reduces terminal wealth by nearly 28%. This is not speculation. It is arithmetic. Thank you for articulating the obvious with precision.

Kasey Drymalla

November 13, 2025 AT 04:27lol they just want you to buy index funds so the banks can keep taking your money. the fed prints money and the rich get richer. you think vti is safe? it’s just a paper tiger. the real money’s in gold, crypto, or cash under the mattress. they don’t want you to know this. they want you to be a sheep. your 401k is a trap. the system is rigged. and they’re laughing at you while you buy voo.

Dave Sumner Smith

November 14, 2025 AT 06:07Who wrote this? Some corporate shill from Vanguard? They don’t tell you that index funds are designed to keep you passive while the hedge funds front-run you every single day. The S&P 500 is manipulated. The Fed buys ETFs. Your money isn’t growing-it’s being diluted. And you think rebalancing is smart? It’s just a way to sell low and buy high for the big boys. You’re not investing. You’re being herded. Wake up. The market isn’t a game. It’s a casino with rigged dice and a velvet rope.

Cait Sporleder

November 16, 2025 AT 05:49What a profoundly thoughtful and meticulously structured exposition on the psychology of long-term wealth accumulation. The author’s articulation of behavioral finance as the true locus of investor failure-rather than market inefficiency-is both elegant and devastatingly accurate. I particularly appreciated the emphasis on dollar-cost averaging as a bulwark against emotional volatility, and the subtle yet powerful distinction between risk and the real peril: premature liquidation. The anecdote of Maria versus Jamal is not merely illustrative; it is a parable for our age. One cannot help but admire the restraint and clarity with which this message is delivered. One only wishes more financial literature possessed such intellectual grace.

Paul Timms

November 16, 2025 AT 19:59This is exactly what I needed to hear. I’ve been overcomplicating everything. Just set it and forget it. Thanks.

Jeroen Post

November 18, 2025 AT 05:51Compounding is a myth created by bankers to pacify the masses. Time doesn’t heal anything. It just hides the decay. The real wealth is in control. Control over your money. Control over your time. Control over the narrative. The market is a mirror of human fear. And fear is the only constant. If you believe in indexes, you believe in the illusion of order. But chaos is the only truth. You think you’re building wealth? You’re just delaying the inevitable collapse. The system is designed to make you compliant. Don’t be fooled. The only real asset is awareness.

Nathaniel Petrovick

November 18, 2025 AT 07:56Man I’ve been doing this for 5 years now and it’s wild how simple it is when you stop overthinking it. I started with $200 a month in VTI and VXUS. Didn’t touch it. Didn’t check it. Got a raise last year and bumped it to $400. My account’s up like 60%. No stress. No drama. Just chill. Seriously, if you’re reading this and scared-just start. Even $25 a month. It’ll add up. You got this.

Honey Jonson

November 20, 2025 AT 04:22omg yes!! i did the exact same thing as maria!! i started with $50 a month and i still forget my password sometimes 😅 but my portfolio’s been growing and i dont even think about it! just keep putting in the money and let it do its thing. no need to be a genius. just be consistent. and if you mess up? who cares. try again tomorrow. you’re doing better than you think 💪❤️

Sally McElroy

November 20, 2025 AT 18:44And yet… still, people don’t listen. They want magic. They want the lottery ticket. They want to be told they can get rich overnight. And so they sacrifice decades of stability for the illusion of a quick win. This isn’t about finance. It’s about morality. The refusal to delay gratification. The worship of novelty over discipline. The surrender to the dopamine-driven chaos of modern life. And now, we wonder why so many are broke at 50. The answer is written in plain sight. But people would rather scroll than think. Shame.