Most people think wealth comes from getting a raise, winning the lottery, or buying a house that skyrockets in value. But the real secret? It’s not about how much you make. It’s about what you do with what you keep. Investments don’t just grow your money-they turn time into your strongest ally.

Why Investments Are the Only Reliable Path to Wealth

Salaries cap. Bonuses vanish. Inflation eats away at cash savings. If you’re relying on your paycheck alone, you’re racing on a treadmill that’s slowly speeding up. Since 1926, the S&P 500 has returned about 10% annually on average-even after crashes, recessions, and pandemics. That’s not luck. That’s how compounding works when money is working for you.

Let’s say you start investing $500 a month at age 25. By 65, with an average 7% return, you’ll have over $1.2 million. If you wait until 35 to start? You’ll end up with just under $600,000. Same monthly amount. Same market. Ten years makes a difference bigger than most people realize.

What Investments Actually Are (And What They’re Not)

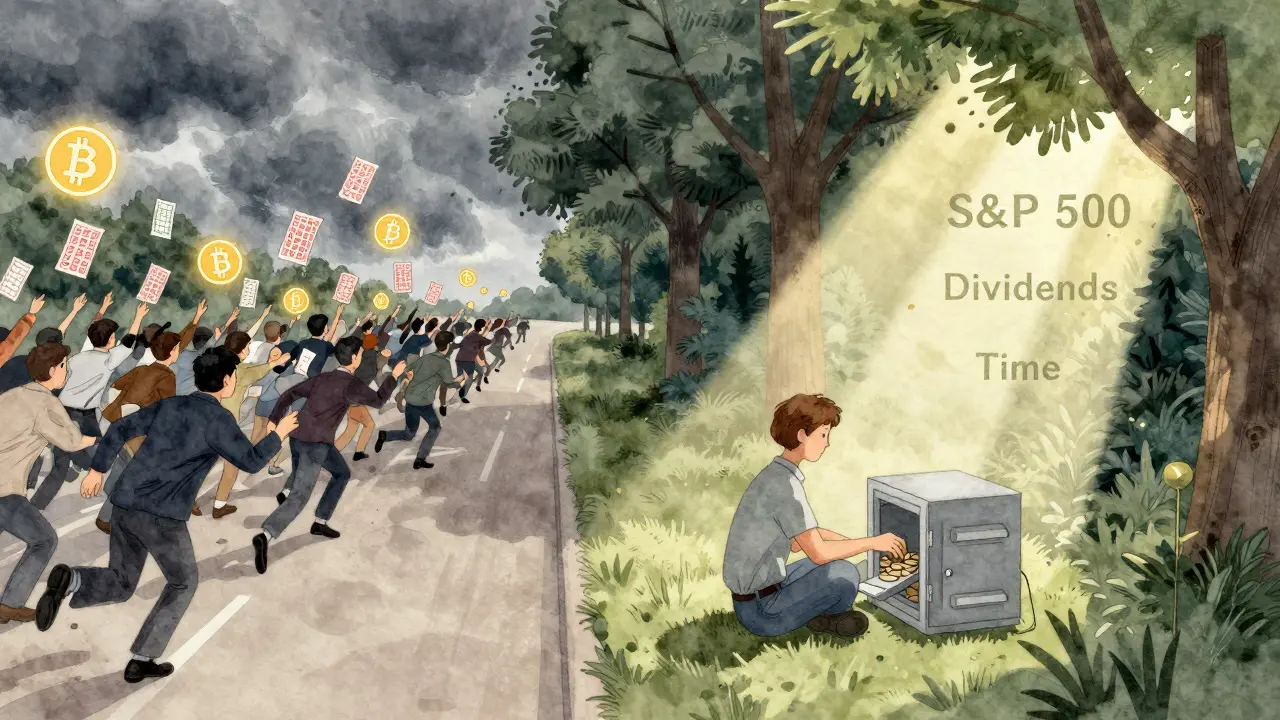

Investments aren’t crypto memes, lottery tickets, or buying a Tesla because Elon Musk tweeted about it. Real investments are assets that generate value over time. That means:

- Stocks in companies that earn profits and pay dividends

- Bonds that pay regular interest

- Real estate that brings in rent or appreciates

- Index funds that track the entire market

These aren’t get-rich-quick tools. They’re slow, steady engines. You don’t need to pick the next Apple. You just need to own a piece of the whole economy.

Most people confuse speculation with investing. Buying a single stock because your cousin says it’s going up? That’s gambling. Buying an S&P 500 index fund that holds 500 of America’s biggest companies? That’s investing. One has a 50/50 shot. The other has a 90%+ chance of growing over 10 years.

The Three Rules No One Tells You About

There’s no magic formula. But there are three rules that separate people who build wealth from those who stay stuck.

- Start early-even with small amounts. A $100 monthly investment at 25 with 7% returns becomes $220,000 by 65. Waiting until 35 cuts that in half. The earlier you begin, the less you need to save each month.

- Stay consistent. You don’t need to time the market. You need to time your effort. Invest every month, rain or shine. Even during crashes. That’s when you buy more shares at lower prices.

- Ignore the noise. Every week, someone on TikTok or YouTube says they turned $500 into $50,000. Those stories are outliers. They’re not your path. Stick to low-cost index funds. Rebalance once a year. Keep fees under 0.2%. That’s the boring secret.

Warren Buffett didn’t become rich by trading. He became rich by owning businesses for decades. He said it best: "Someone’s sitting in the shade today because someone planted a tree a long time ago."

Where to Start: Simple, Proven Options

You don’t need a financial advisor to begin. You don’t need to understand derivatives or options. Here’s what works for 95% of people:

- 401(k) or IRA: If your employer offers a match, contribute enough to get the full match. That’s free money. Open a Roth IRA if you can. Contributions grow tax-free.

- Low-cost index funds: Vanguard’s VTI (Total Stock Market) or Fidelity’s FXAIX (S&P 500) have fees under 0.02%. These track the entire U.S. stock market. You own a slice of Amazon, Microsoft, Coca-Cola, and more-all in one fund.

- Automate it: Set up automatic transfers from your checking account to your investment account. $100, $200, $500-it doesn’t matter. What matters is that it happens without you thinking about it.

Most people overcomplicate this. You don’t need 10 different funds. You don’t need to watch the market every day. You need one good fund, automated, and patience.

The Hidden Cost of Not Investing

People think the risk is in investing. But the real risk is staying out.

Let’s say you keep $10,000 in cash for 20 years. With 3% inflation, that $10,000 will only buy what $5,500 buys today. You’ve lost nearly half your buying power-without touching a single stock.

Meanwhile, if you’d invested that same $10,000 in the S&P 500 in 2005, it would’ve grown to over $30,000 by 2025. That’s not speculation. That’s math.

Not investing isn’t safe. It’s a silent wealth killer.

Common Mistakes That Drain Your Potential

Even smart people mess this up. Here are the top three mistakes I’ve seen over and over:

- Chasing hot stocks. GameStop, Bitcoin, NFTs-these are distractions. They don’t build long-term wealth. They create temporary excitement and permanent losses for most.

- Waiting for the "perfect" time. There’s no perfect time. The market always looks expensive when you’re starting. That’s normal. The best time to plant a tree was 20 years ago. The second best time is today.

- Thinking you need a lot of money. You don’t. You need consistency. $25 a week invested for 30 years at 7% returns? That’s over $30,000. That’s not a fortune. But it’s enough to pay for a car, a vacation, or a down payment on a home.

What Wealth Looks Like in Real Life

Real wealth isn’t a Lamborghini or a mansion. It’s not having to choose between paying the electric bill and fixing the car. It’s knowing your kids’ college fund is covered. It’s being able to take a year off to care for a parent. It’s retiring without worrying if your money will last.

One of my neighbors in Chicago retired at 62. He never made more than $70,000 a year. But he started investing $300 a month in an S&P 500 index fund at 28. He never touched it. He didn’t panic during 2008 or 2020. He just kept going. Now he lives on dividends and Social Security. No debt. No stress.

That’s the goal. Not to be rich. To be free.

What Comes Next

You don’t need to become an expert. You just need to start. Open an account. Set up one automatic transfer. Pick one index fund. Then forget about it for a year.

Check in once a year. Rebalance if you need to. Increase your contribution when you get a raise. That’s it.

Building wealth isn’t about genius moves. It’s about showing up, day after day, year after year. The market doesn’t care how smart you are. It only cares if you’re still there.

Do I need a lot of money to start investing?

No. You can start with as little as $10 or $25 a month. Many brokers let you buy fractional shares, so you can invest in high-priced stocks like Amazon or Google without buying a full share. The key isn’t how much you start with-it’s that you start and stay consistent.

Is investing in stocks safe?

Short-term? No. The market can drop 20%, 30%, even 50% in a year. But long-term? Yes. Since 1926, the S&P 500 has never lost money over any 20-year period. The risk isn’t in owning stocks-it’s in selling them when they’re down. Stay invested, and you’re playing a game you almost always win.

Should I invest in real estate instead of stocks?

Real estate can be great, but it’s not easier or safer than stocks. It requires more hands-on work, more upfront cash, and more maintenance. For most people, index funds are simpler, more liquid, and offer better diversification. You can invest in real estate later-once you’ve built a solid foundation with low-cost, passive investments.

What’s the best investment for beginners?

A low-cost S&P 500 index fund like Vanguard’s VFIAX or Fidelity’s FXAIX. It holds the 500 largest U.S. companies. It’s diversified, low-fee, and historically returns about 10% a year over the long term. It’s the simplest, most proven way to start.

How often should I check my investments?

Once a year is enough. Checking daily or weekly only leads to stress and bad decisions. The market moves every second. Your plan shouldn’t. Set up automatic contributions, pick your fund, and check in once a year to make sure you’re still on track.

Jeremy Chick

December 17, 2025 AT 01:39Bro, I started with $50 a month in VTI at 22. Now I’m 31 and I’ve got over $80k. No fancy tricks. No crypto scams. Just automation and ignoring the news. People act like investing is rocket science-it’s not. It’s just not spending the money you don’t need right now. Simple as that.

Also, if you’re waiting for a "good time" to start, you’re already behind. The market doesn’t wait. Neither should you.

Sagar Malik

December 17, 2025 AT 06:38While the conventional narrative posits that passive indexation constitutes the sole viable pathway to intergenerational capital accumulation, one must interrogate the underlying epistemological assumptions of this paradigm. The S&P 500, after all, is a construct of neoliberal hegemony-a curated oligopoly of corporate behemoths that externalize labor exploitation and environmental degradation. Are we truly building wealth, or merely legitimizing systemic extraction under the veneer of financial literacy?

Moreover, the 7% historical return is a statistical illusion, predicated on a post-WWII American exceptionalism that is no longer tenable. Inflation, debt monetization, and the Fed’s zombie market interventions render such projections obsolete. The real investment? Owning physical gold. And maybe a bunker.

Seraphina Nero

December 17, 2025 AT 09:34I love this post. My mom never talked about money, so I thought investing was for rich people. I started with $25 a month last year. Just $25. And now I check my account once a month and it makes me feel so calm. I’m not rich, but I’m not scared anymore. That’s worth more than any car or house.

Megan Ellaby

December 17, 2025 AT 11:37OMG YES. I used to think I needed to be a genius to invest. Then I found out you can buy like 0.03 of a share of Apple with $10. I started with $100 a month from my side hustle. I don’t even think about it anymore. It just happens. And honestly? The best part isn’t the money-it’s the peace of mind. No more panic-scrolling TikTok finance gurus.

Also, I just turned 28 and I’ve got more in my IRA than I did in my savings account at 25. Mind blown.

Rahul U.

December 18, 2025 AT 22:39Beautifully articulated. 🙌 I’m from India, and here, most people still think mutual funds are "gambling." But my uncle started SIPs in an index fund at 30 with ₹5,000/month. Now at 52, he’s retired with a house, no debt, and travels every year. No lottery. No inheritance. Just consistency. 🇮🇳❤️

Start small. Stay steady. Let time do the heavy lifting.

E Jones

December 19, 2025 AT 14:53Let me tell you something they don’t want you to know. The entire financial system is rigged. The S&P 500? It’s not the market-it’s a propaganda tool designed by Wall Street and the Fed to keep sheeple docile while they print trillions and inflate asset bubbles. You think you’re building wealth? You’re just feeding the machine.

And don’t get me started on 401(k)s. That’s not retirement-it’s a debt trap disguised as savings. Your money is being used to bail out banks while you’re told to "just keep contributing."

Real wealth is in land. In cash. In crypto. In gold. In bartering. In disconnecting from the system entirely. The only reason you’re hearing about index funds is because they’re the easiest way to keep you trapped in the matrix. Wake up. The 7% return? It’s a lie. The real return is the loss of your freedom.

I’m not saying don’t invest. I’m saying invest in *yourself*. Learn to grow food. Learn to build. Learn to survive without the system. That’s the only true hedge against collapse.

Barbara & Greg

December 20, 2025 AT 14:16While the sentiment expressed in this post is commendable in its emphasis on discipline and long-term thinking, it is deeply problematic in its implicit endorsement of capitalist accumulation as a moral imperative. The notion that wealth is achieved through passive index fund ownership reinforces a dangerous myth: that individual financial behavior alone can overcome structural inequality.

One cannot "invest one’s way out" of systemic wage stagnation, healthcare debt, or generational poverty. The author’s neighbor in Chicago may have retired comfortably, but what of the millions who cannot afford even $300 a month? This narrative is not inclusive-it is exclusionary under the guise of empowerment.

True wealth-building requires policy change, not personal finance hacks.

selma souza

December 21, 2025 AT 05:36"Low-cost index funds have fees under 0.2%."

Correction: Vanguard’s VTI has an expense ratio of 0.03%. FXAIX is 0.015%. Please stop misquoting numbers. Accuracy matters. Also, "$100 a month becomes $220k"-that’s not even close. At 7% over 40 years, it’s $247k. You’re off by 11%.

And don’t say "you don’t need to understand derivatives." You don’t need to, but if you’re going to give financial advice, at least get the basics right.

Frank Piccolo

December 22, 2025 AT 21:10Look, I get it. Buy the index. Be boring. Stay consistent. But let’s be real-this whole "investing is the only way" thing is just American propaganda. Other countries don’t even have 401(k)s. They have social safety nets. Why are we acting like individual financial discipline is the solution to systemic collapse?

Also, if you’re telling people to invest in the S&P 500, you’re telling them to bet on American corporate dominance. What happens when China’s economy outpaces ours? What happens when the dollar collapses? You think your index fund will save you?

I’m not saying don’t invest. I’m saying don’t be naive. The game is rigged, and the house always wins. Maybe we should be talking about how to fix the system instead of how to play it better.