Most people think financial freedom means winning the lottery or landing a six-figure job. But the real path to freedom doesn’t come from luck or a raise. It comes from small, consistent investments that grow over time. If you’re just starting out, you don’t need to be a math genius or have thousands to spare. You just need to start. And you need to understand what actually works.

What Financial Freedom Really Means

Financial freedom isn’t about retiring at 40 with a private jet. It’s about having enough money coming in from sources you didn’t have to trade time for - so you can choose how to spend your days. Maybe that means quitting a job you hate, working part-time, traveling, or starting a side project. The goal isn’t to be rich. It’s to be free.

People who reach this point didn’t save every dollar. They didn’t skip every coffee. They built systems. Systems that made money while they slept. That’s what investments do. They turn your money into workers.

Why Most Beginners Fail (And How to Avoid It)

The biggest mistake beginners make? They chase hot stocks. They see someone on TikTok making 50% in a week and think, ‘That’s me.’ Then they buy a crypto coin with no real use, or a meme stock with no earnings. A year later, they’re down 70% and give up on investing entirely.

Here’s the truth: 90% of individual investors underperform the market over 10 years. Why? Because they react to noise. They panic-sell when the market dips. They jump in when everyone’s talking about the next big thing. They don’t have a plan.

The fix is simple: ignore the noise. Focus on the basics. Start with low-cost index funds. They track the whole market - not one risky stock. They cost less than 0.1% in fees. And they’ve outperformed 80% of professional fund managers over the last 20 years, according to the SPIVA U.S. Scorecard.

How to Start With Just $100

You don’t need $10,000 to begin. You need $100 and a plan. Here’s how:

- Open a brokerage account with a low-cost provider like Fidelity, Charles Schwab, or Vanguard. These platforms have no account fees and let you buy fractional shares.

- Choose one broad-market index fund. The S&P 500 index fund (like VOO or SPY) is the most popular. It gives you a slice of 500 of the biggest U.S. companies - Apple, Microsoft, Amazon, and more.

- Invest $100 now. Then set up an automatic transfer of $50 every two weeks. Even if you can only afford $25 a month, start.

That’s it. No research. No stock picking. No timing the market. Just consistent money going in. Over 10 years, even $50 a month at 7% annual returns grows to over $8,000. At 10%, it’s nearly $11,000. That’s the power of compound interest.

Compound Interest: Your Secret Weapon

Compound interest isn’t magic. It’s math. But it’s the most powerful math you’ll ever use.

Let’s say you start at age 25 and invest $200 a month. At 7% annual returns, you’ll have about $400,000 by 65. If you wait until 35 to start - same monthly amount - you’ll have just $190,000. Ten years makes a difference bigger than doubling your monthly contribution.

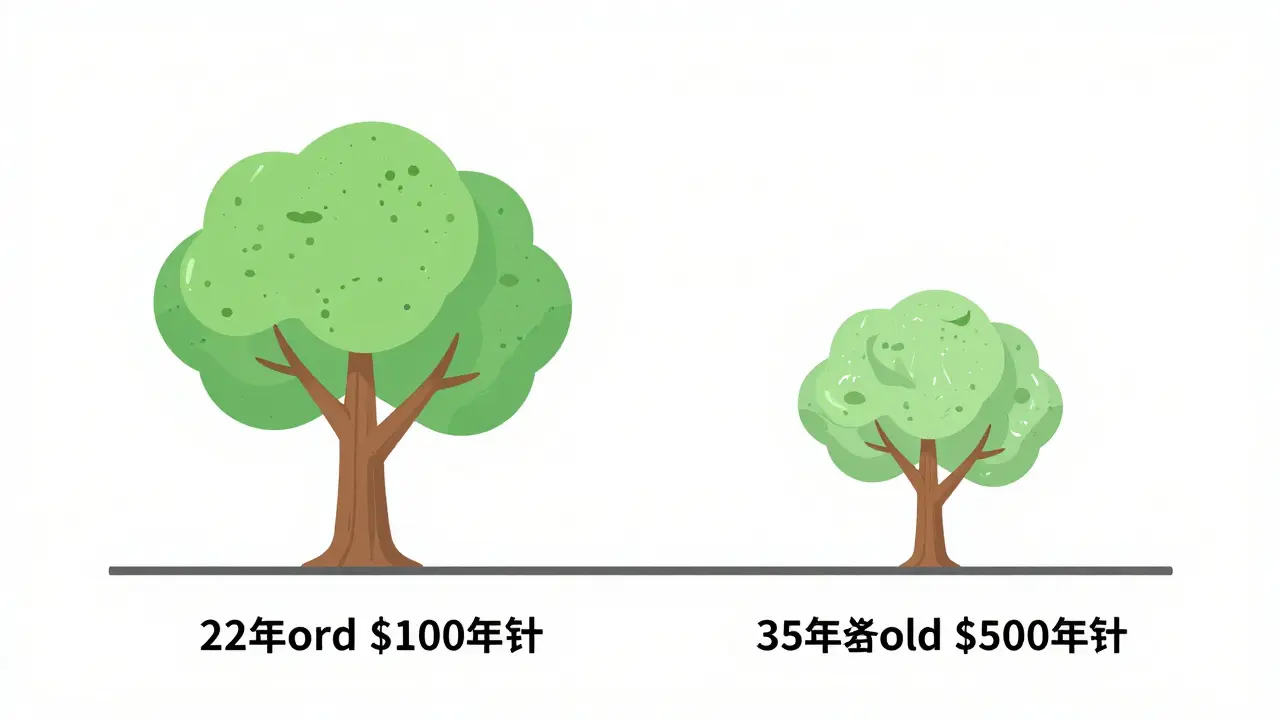

That’s why starting early matters more than how much you put in. A 22-year-old who saves $100 a month will end up richer than a 35-year-old who saves $500 a month - if both earn the same returns. Time is your edge. Don’t waste it.

What to Avoid Like the Plague

Here are five traps that kill beginner portfolios:

- Trying to time the market - Nobody consistently predicts when the market will rise or fall. Even professionals fail at this.

- Buying individual stocks without research - Unless you’re willing to spend 10+ hours a week analyzing companies, stick to index funds.

- Chasing high-yield savings accounts - Yes, 5% interest sounds great. But inflation is 3%. Your real return is 2%. That won’t build wealth.

- Using credit cards to invest - Never borrow money to invest. The risk is too high, and interest rates eat your gains.

- Listening to financial influencers - Most are selling courses or affiliate links. Real wealth builders don’t post daily stock picks.

Where to Put Your Money After You Start

Once you’ve got your index fund running, here’s the next step:

- Build a small emergency fund - $1,000 to start. Keep it in a high-yield savings account (like Ally or Marcus). This is your safety net.

- Pay off high-interest debt - Credit cards at 20%+ interest are a wealth killer. Pay those off before investing more.

- Max out your retirement accounts - If your employer offers a 401(k) match, contribute enough to get the full match. It’s free money. Then open a Roth IRA and contribute up to $7,000 a year (2025 limit).

- Expand your investments - After you’re comfortable, add a total stock market fund (like VTSMX) or a low-cost international fund (like VXUS). But keep it simple. Three funds are enough.

That’s the full beginner roadmap: emergency fund → pay debt → invest in retirement → grow slowly.

Real People, Real Results

Meet Sarah. She was 28, making $42,000 a year, working two jobs. She started investing $150 a month in an S&P 500 index fund. She didn’t touch it. She didn’t check it daily. Five years later, she had $11,000. She used it to pay off her student loans. Now she invests $400 a month. At 33, she’s on track to retire by 55 - not because she got a raise, but because she started early and stayed consistent.

Or take James. He was 35, had $5,000 in credit card debt, and thought investing was for rich people. He paid off his debt first. Then he opened a Roth IRA and started with $50 a month. Two years later, he had $1,500 in investments and no debt. He’s not rich. But he’s no longer afraid of the future.

You don’t need to be rich to start. You just need to start.

What Comes Next?

Don’t wait for the perfect time. Don’t wait until you have more money. Don’t wait until you ‘understand more.’ The best time to start was yesterday. The next best time is now.

Open that account. Set up that $50 transfer. Let your money work while you live your life. In five years, you’ll look back and wonder why you didn’t start sooner.

Can I invest with only $50 a month?

Yes. Many brokerage platforms let you buy fractional shares, so you can invest $50 in an S&P 500 index fund even if the share price is $500. Consistency matters more than the amount. $50 a month for 30 years at 7% returns grows to over $60,000.

Is investing safe for beginners?

Investing in broad index funds is one of the safest ways to grow wealth over time. While the market goes up and down, the S&P 500 has returned about 7% per year on average after inflation over the last 100 years. You won’t get rich overnight, but you’ll almost certainly be better off than keeping cash in a savings account.

Should I use a financial advisor as a beginner?

Not unless you have over $100,000 to invest. Most advisors charge 1% of your assets per year - meaning they take $1,000 from every $100,000 you have. For beginners, a low-cost index fund and a free online resource like Bogleheads.org are more effective and cost nothing.

What’s the difference between a Roth IRA and a 401(k)?

A 401(k) is offered through your employer. Contributions are made before taxes, and you pay taxes when you withdraw in retirement. A Roth IRA is opened individually. You pay taxes now, but withdrawals in retirement are tax-free. Both are great. If your employer matches your 401(k), contribute enough to get the full match first. Then fund a Roth IRA.

How often should I check my investments?

Once a quarter is enough. Checking daily or weekly leads to stress and bad decisions. The market moves every day, but your long-term plan shouldn’t change with the news. Focus on adding money regularly, not on daily price swings.

What if the market crashes?

Markets crash. They always have. But they’ve always recovered. If you’re investing monthly, a crash means you’re buying shares at lower prices - which helps your long-term returns. The key is to keep contributing. Don’t stop. Don’t sell. Let your investments recover with time.

If you’re reading this and thinking, ‘I’m too late,’ you’re not. If you’re thinking, ‘I don’t have enough,’ you’re wrong. Financial freedom isn’t about how much you earn. It’s about how consistently you invest. Start today. Let time do the rest.

amber hopman

December 22, 2025 AT 10:06I started with $50 a month last year and just hit $3,200. I don’t even check it anymore. It’s wild how little you need to do when you let it sit. I used to think I had to be some finance nerd to get ahead. Turns out I just needed to stop overthinking it.

Also, I switched from my bank’s savings account to a high-yield one for my emergency fund. Got 4.5% vs 0.1%. That alone felt like a win.

Jim Sonntag

December 23, 2025 AT 03:54investing is just compound interest with a fancy name

also if you’re not buying voo or spy you’re doing it wrong

and no i don’t work for vanguard i just watch my portfolio grow while my friends lose money on dogecoin

Deepak Sungra

December 24, 2025 AT 15:53bro i tried this and my account went down 15% in 3 months and i cried for a week

then i just put all my money in gold and now i sleep like a baby

also i bought a lamborghini last year so who even needs index funds anyway

Samar Omar

December 25, 2025 AT 09:27It’s fascinating, really, how the neoliberal paradigm has co-opted the very notion of financial autonomy and repackaged it as a personal responsibility narrative-ignoring structural inequality, wage stagnation, and the erosion of social safety nets.

One must ask: can one truly achieve ‘freedom’ through index funds when systemic forces ensure that the majority of wealth remains concentrated in the hands of the top 1%? The suggestion that $50 a month is a viable path to liberation is not merely optimistic-it is dangerously naive.

And yet… I did start a Roth IRA last month. I’m not proud of it.

But I did. And I’m still waiting for the revolution to catch up with my portfolio.

chioma okwara

December 26, 2025 AT 21:35u spelled investin wrong in the title and u said s&p 500 but u meant sp500 right??

also i started with 20$ and now i have 500 and i dont even know how

u said dont listen to influencers but u r one so lol

John Fox

December 27, 2025 AT 15:41just set it and forget it

i dont check mine once a year

my wife thinks im crazy but i have more than her and she works 60 hours a week

weird right

Sarah Meadows

December 29, 2025 AT 07:50Let’s be clear-this isn’t about ‘investing.’ This is about patriotism. The S&P 500 is the backbone of American economic might. Investing in it isn’t just smart-it’s a civic duty.

Foreign markets? Overrated. Emerging economies? Risky distractions. Stick to the American engine. That’s how real wealth is built.

And if you’re not maxing out your 401(k) with your employer match, you’re literally leaving free money on the table. That’s not just bad finance-it’s unpatriotic.

VIRENDER KAUL

December 29, 2025 AT 14:13While your assertions regarding index fund performance are statistically valid, you have omitted a critical variable: the tax implications of capital gains realization under Section 1202 of the Internal Revenue Code, particularly for high-income earners in progressive states.

Moreover, the assumption of 7% annualized returns is predicated on historical data from 1926–2020, a period characterized by unprecedented monetary expansion, demographic tailwinds, and global hegemony-conditions unlikely to persist.

Furthermore, the notion that ‘$50/month is sufficient’ neglects the psychological burden of long-term compounding in an era of inflationary volatility and declining real wages.

Nevertheless, your core thesis-that consistent, low-cost, passive investing outperforms speculative behavior-is empirically sound. I would, however, recommend augmenting your portfolio with a 10% allocation to Treasury Inflation-Protected Securities (TIPS) for true risk mitigation.