Most people think stock trading is about quick wins-buying a hot stock, riding the wave, and cashing out before the next news drop. But if you want to build real wealth, that approach will burn you. The truth? Wealth from stocks isn’t made in a day. It’s built over years, with discipline, strategy, and patience. You don’t need to be a Wall Street insider. You don’t need to watch charts 12 hours a day. You just need to understand how the game actually works-and play it the right way.

Stock Trading Isn’t Gambling-If You Do It Right

Let’s clear this up first: trading stocks isn’t the same as betting on a sports game. Gambling is pure chance. Trading, when done right, is probability management. You’re not guessing if a stock will go up. You’re using data, history, and logic to tilt the odds in your favor.

Take Apple. In 2010, it traded around $30 a share. By 2025, it hit $220. Someone who bought 100 shares then and held them made over $19,000 in profit-before dividends. That’s not luck. That’s understanding a company’s growth, its products, and its market position. You don’t need to time the exact bottom. You need to recognize durable value.

Studies from the Dalbar Institute show that the average investor earns just 3.8% annually over 20 years, while the S&P 500 returns 9.8%. Why? They buy high, panic-sell low, and chase trends. That’s gambling. Real trading means staying in the game through the noise.

Start With a Plan-Not a Dream

Before you buy your first share, write down three things:

- Why you’re trading (retirement? early freedom? education fund?)

- How much you can afford to lose without hurting your life

- How long you’re willing to wait (1 year? 10 years?)

Most people skip this. They see a meme stock go up 500% in a week and think, “I’ll get rich too.” Then they lose half their money in the next crash. That’s not trading. That’s self-sabotage.

Set a realistic goal. If you want $500,000 in 15 years, you don’t need to hit home runs. You need to earn about 8% a year consistently. That’s doable with index funds, blue-chip stocks, and smart reinvestment. You don’t need to outsmart the market. You just need to stay in it.

Choose Your Style-And Stick to It

There are three main ways people trade stocks. Pick one and stick with it. Switching between styles is how people lose money.

- Long-term investing: Buy stocks in solid companies and hold for 5+ years. Think Coca-Cola, Johnson & Johnson, or Microsoft. You care about earnings growth, dividends, and balance sheets. This is how most millionaires built their wealth.

- Swing trading: Hold stocks for days to weeks. You look for price patterns, volume spikes, and news catalysts. You’re not day trading-you’re riding trends. Requires discipline and a trading journal.

- Day trading: Buy and sell within the same day. This is high-risk, high-stress, and only for a tiny fraction of people with deep experience, fast internet, and emotional control. Most day traders lose money. Don’t start here.

For 95% of people, long-term investing is the only sane choice. You don’t need to watch the market every minute. You just need to check in once a quarter, reinvest dividends, and ignore the headlines.

Build a Portfolio That Doesn’t Panic

Don’t put all your money in one stock-even if it’s Tesla or Nvidia. Diversification isn’t just a buzzword. It’s your safety net.

Here’s a simple portfolio structure that works for most people:

- 50% in low-cost index funds (like VOO or SPY-tracks the S&P 500)

- 30% in 5-8 solid dividend stocks (like PG, JNJ, KO, MMM)

- 15% in growth stocks with strong fundamentals (like Adobe, Mastercard, or NVIDIA)

- 5% in cash or bonds for emergencies

This isn’t flashy. But over 10 years, it compounds. A $10,000 investment in VOO in 2015 grew to over $30,000 by 2025. Add dividends and you’re at $35,000+. That’s not magic. That’s math.

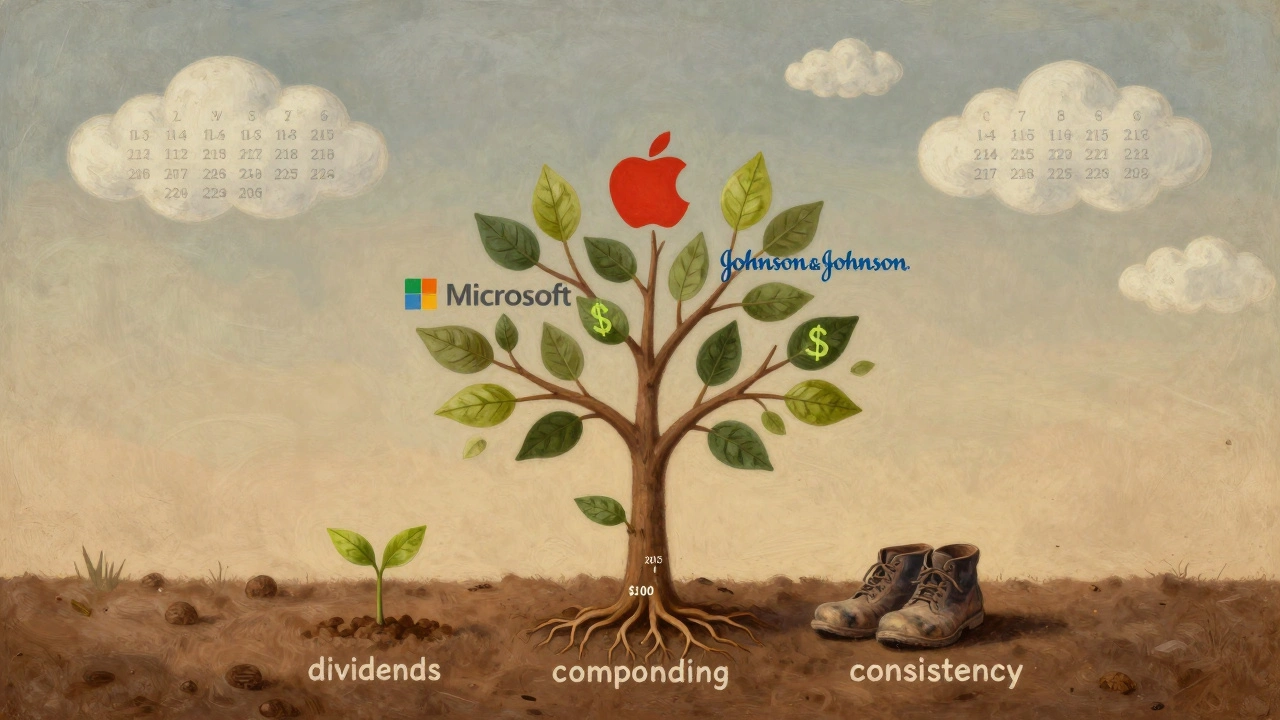

Dividends Are Your Secret Weapon

Most beginners ignore dividends. Big mistake. Dividends are cash the company pays you just for owning the stock. Reinvest them, and you’re buying more shares without adding new money.

Let’s say you buy $10,000 worth of Johnson & Johnson stock in 2015. It pays a 2.5% dividend. You reinvest every payout. By 2025, you’d own 28% more shares than you started with-even if the stock price hadn’t moved at all. Combine that with the stock’s 150% price gain, and your total return jumps from 150% to over 220%.

Companies that pay and raise dividends year after year are usually profitable, stable, and well-managed. They’re not the flashiest, but they’re the ones that build wealth quietly.

Emotions Are Your Worst Enemy

The biggest threat to your wealth isn’t the market. It’s you.

When the market drops 10%, do you panic-sell? When a stock you bought goes up 50%, do you sell too early because you’re scared it’ll fall? That’s human nature. But it’s also the fastest way to lose money.

Here’s a simple rule: If you bought a stock because the company is strong and the price is fair, then short-term moves shouldn’t matter. A 20% drop in a week? That’s noise. A 20% drop over two years because the business is failing? That’s a signal.

Keep a trading journal. Write down why you bought each stock. Then, when it moves, check your notes. Did your original reason still hold? If yes, hold. If no, sell. Not because of fear or greed. Because the facts changed.

What to Avoid at All Costs

Here’s a short list of traps that destroy wealth:

- Meme stocks: Dogecoin, GameStop, AMC. They have no earnings, no real business model, and are driven by social media hype. They’re lottery tickets.

- Margin trading: Borrowing money to buy stocks. It doubles your gains-but also your losses. Most people who use it end up wiped out.

- Chasing hot tips: “My cousin heard from his buddy that XYZ stock is going to 10x!” If it’s that good, why is your cousin telling you? Real opportunities don’t spread through text chains.

- Overtrading: Buying and selling too often. Every trade costs money-fees, taxes, spreads. The more you trade, the more you pay to lose.

Stick to what you understand. If you can’t explain how a company makes money in one sentence, don’t buy it.

Tools That Actually Help

You don’t need fancy software. You need simple, reliable tools:

- Brokerage account: Use Fidelity, Charles Schwab, or Vanguard. Low fees, no hidden charges, solid research tools.

- Portfolio tracker: Yahoo Finance or Google Finance. Free. Easy. Shows your gains, losses, and dividend history.

- Dividend reinvestment: Enable DRIP (Dividend Reinvestment Plan) on your broker. Automatic. Hands-off. Powerful.

- Annual review: Once a year, look at your holdings. Are the companies still strong? Are they still aligned with your goals? Adjust if needed.

That’s it. No need for Bloomberg terminals. No need for AI bots. Just consistency.

Real People, Real Results

Meet Sarah, 42. She started with $500 a month in 2018. She put it all into VOO and three dividend stocks: Coca-Cola, Procter & Gamble, and Verizon. She never touched it. She didn’t check it daily. She just kept adding $500 every month.

In 2025, her portfolio is worth $187,000. She didn’t get lucky. She didn’t time the market. She just showed up every month, ignored the noise, and let compounding do its work.

Or take James, 58. He retired early in 2023 because his dividend income covered his living costs. He never owned a single tech stock. His portfolio was made of utilities, consumer staples, and REITs. He earned $4,200 a month in dividends. No job. No stress. Just steady cash.

You don’t need to be a genius. You just need to be consistent.

What Comes Next?

Start small. Open a brokerage account. Set up automatic transfers of $100 a month. Buy one index fund. Wait. Then add another. In a year, you’ll know more than 80% of people who think they’re “investing.”

Don’t wait for the perfect moment. There isn’t one. The best time to start was 10 years ago. The second-best time is today.

Can you really build wealth with stock trading?

Yes-but not by chasing quick gains. Wealth is built through consistent investing in strong companies, reinvesting dividends, and staying invested through market ups and downs. People who stick to long-term strategies and avoid emotional decisions consistently outperform those who trade frequently or follow trends.

How much money do I need to start?

You can start with as little as $100. Many brokers now allow fractional shares, so you can buy a piece of Amazon or Google for $50. The key isn’t how much you start with-it’s how consistently you add to it. Even $50 a month, invested for 20 years, can grow to over $30,000 with average market returns.

Should I invest in individual stocks or index funds?

For beginners, index funds are the safer, smarter choice. They spread your risk across 500+ companies and have lower fees. Once you understand how markets work, you can add a few individual stocks for growth. But don’t skip the index fund base-it’s the foundation of most successful portfolios.

Is day trading a good way to get rich?

No. Less than 10% of day traders make consistent profits over time. The odds are stacked against you due to fees, taxes, and emotional pressure. Most people who try it lose money. If you want to build wealth, focus on long-term investing instead.

How do I know when to sell a stock?

Sell when your original reason for buying no longer holds. If the company’s earnings are declining, its debt is rising, or its competitive edge is fading, it’s time to reconsider. Don’t sell just because the price dropped. Don’t hold just because you’re hoping it’ll bounce back. Base your decision on facts, not feelings.

What’s the biggest mistake new traders make?

Trying to time the market. People wait for the “perfect” entry point, then panic when prices dip. The real secret? Time in the market beats timing the market. Starting early and staying invested-even through downturns-is what creates wealth over time.

Building wealth through stock trading isn’t about being the smartest person in the room. It’s about being the most patient. It’s about showing up every month, ignoring the headlines, and trusting the process. The market doesn’t reward the loudest. It rewards the most consistent.

Amanda Harkins

December 4, 2025 AT 23:09It's funny how people treat the market like it's a casino, but then act shocked when they lose. I just buy a little every month and forget about it. My portfolio doesn't make headlines, but it doesn't make me lose sleep either.

Jeanie Watson

December 5, 2025 AT 18:31Yeah, but what if you’re just… not that into it? Like, I get it, but I’d rather spend my weekends not thinking about stocks.

Tom Mikota

December 6, 2025 AT 21:39So… you’re saying the entire financial industry is built on lies, and the only way to win is to be boring? I mean, sure. But also, you’re basically telling people to become a human index fund with a heartbeat. And honestly? That’s the most radical advice I’ve heard all year.

Mark Tipton

December 7, 2025 AT 05:01Let’s be clear: this article is dangerously oversimplified. The Dalbar Institute’s data is flawed-it ignores tax-loss harvesting, asset allocation rebalancing, and behavioral finance nuances. Also, VOO’s 2015–2025 performance was a once-in-a-generation bull market fueled by zero interest rates and Fed liquidity. To suggest this is replicable without acknowledging systemic monetary manipulation is irresponsible. And don’t get me started on dividend reinvestment-most DRIPs don’t account for foreign withholding taxes, especially on international dividend stocks. You’re not building wealth-you’re just riding a bubble dressed up as discipline.

Adithya M

December 8, 2025 AT 00:40Bro, you're right on point. I started with $200 last year, now I have over $1,200 just from monthly SIPs in index funds. No drama, no hype. Just buy and wait. People in India think they need to chase penny stocks, but that’s just gambling with a desi accent. Stick to the plan.

Salomi Cummingham

December 9, 2025 AT 07:08I’ve been doing this for 17 years now. I remember the dot-com crash. I remember 2008. I remember the pandemic drop. And every single time, I sat there with my tea, my journal, and my quiet resolve. I didn’t sell. I didn’t panic. I didn’t even check my balance for weeks. And you know what? The market came back-not because I was smart, but because I was stubborn. And now, every quarter, I get a little check in the mail from companies that have been paying dividends since before I was born. That’s not investing. That’s legacy-building. And honestly? It’s the only thing that makes me feel like I’ve done something right.

Johnathan Rhyne

December 10, 2025 AT 17:37So you’re telling me the secret to wealth is… not being a dumbass? Wow. Groundbreaking. Next you’ll tell me breathing is good for your lungs. But seriously-this is the most common-sense thing I’ve read in years. Meme stocks? Yeah, they’re like Tinder dates: hot for five minutes, then you’re left holding a ghost and a bill. I bought my first share of JNJ in 2012. I still own it. My dog knows more about dividends than my ex-wife did.

Jawaharlal Thota

December 11, 2025 AT 12:13I’ve seen so many young people in my village chase crypto and day trading, thinking they’ll become rich overnight. I told one of them to just start with ₹500 a month in an index fund. He laughed. Last month, he came back to me crying-he lost ₹40,000 in one week on a meme coin. I didn’t say ‘I told you so.’ I just handed him a cup of chai and said, ‘Start again tomorrow.’ The market doesn’t care how loud you are. It only rewards those who show up quietly, day after day. That’s the real wisdom.

Lauren Saunders

December 11, 2025 AT 14:38How quaint. A 2020s version of ‘buy and hold’ dressed up as revolutionary insight. Did you forget that inflation has eroded 40% of purchasing power since 2015? That VOO’s outperformance was a function of monopolistic tech giants and artificial liquidity, not some moral virtue of patience? And let’s not pretend dividend stocks are ‘safe’-they’re just slower to implode. If you’re truly serious about wealth, you’d be studying macroeconomic cycles, currency debasement, and alternative assets-not reciting Warren Buffett quotes like they’re scripture. This is financial comfort food for the middle class. It’s not a strategy-it’s an emotional crutch.