Most people think stock trading is about quick wins, flashy charts, and lucky guesses. The truth? It’s a skill built on discipline, preparation, and understanding how markets actually move. If you’ve ever watched a stock spike overnight and wondered how to get in before it happens, you’re not alone. But jumping in without a plan is like driving blindfolded-you might hit something, but you won’t know if it was a curb or a cliff.

What Stock Trading Really Means

Stock trading isn’t the same as investing. Investing means buying shares in companies you believe will grow over years. Trading means buying and selling those same shares over days, hours, or even minutes to profit from price changes. You’re not betting on a company’s future-you’re betting on what other traders think right now.

Traders use price patterns, news events, volume spikes, and technical indicators to make decisions. They don’t wait for quarterly earnings reports. They watch for breakouts, pullbacks, and sudden shifts in sentiment. The goal isn’t to own a piece of Apple forever-it’s to buy Apple at $170 and sell it at $175 before lunch.

According to the Securities and Exchange Commission, over 70% of retail traders lose money in their first year. Why? They treat it like gambling. The ones who stick around learn to treat it like a job-with rules, routines, and risk limits.

How to Start Trading Stocks (Step by Step)

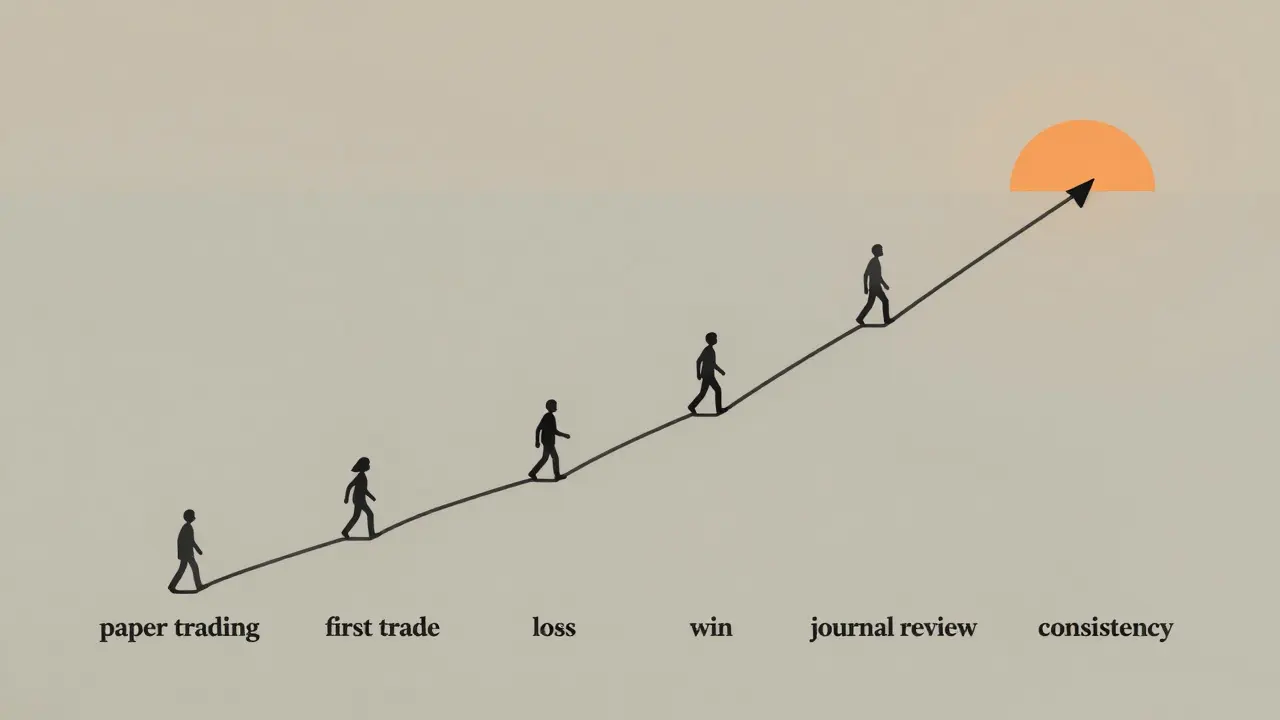

Here’s how real traders begin-not with hype, but with structure.

- Open a brokerage account with a platform that offers low fees, real-time data, and good charting tools. Popular choices include Interactive Brokers, TD Ameritrade, and Fidelity. Avoid apps that gamify trading with confetti and rewards-they’re designed to get you to trade more, not better.

- Start with paper trading. Use a simulator to practice buying and selling with fake money. Do this for at least 3 months. You’ll learn how emotions mess with your decisions before you risk real cash.

- Choose one strategy and stick with it. Day trading? Swing trading? Scalping? Pick one. Don’t jump between styles. Most beginners fail because they chase every trend instead of mastering one.

- Define your risk rules. Never risk more than 1% of your account on a single trade. If you have $5,000, that’s $50 max loss per trade. This keeps you alive through losing streaks.

- Track every trade. Write down why you entered, what your target was, and what went wrong or right. Review this weekly. Your journal is your best teacher.

Common Trading Strategies Explained Simply

Not all trading looks the same. Here are three realistic approaches used by consistent traders.

- Day trading: Opening and closing positions within the same day. Requires focus, fast execution, and access to Level 2 quotes. Best for people who can sit in front of a screen 6+ hours a day. Most day traders use 5-minute or 15-minute charts to spot momentum moves.

- Swing trading: Holding positions for a few days to a couple of weeks. You’re riding price swings between support and resistance levels. This works well for people with full-time jobs. You don’t need to watch the market constantly-just check it before market open and close.

- Scalping: Making dozens of tiny trades to capture pennies per share. Requires ultra-low commissions and high-speed tools. Only viable with a large account size ($25k+). Most retail traders avoid this-it’s more like a high-pressure job than trading.

Swing trading is the most accessible for beginners. It doesn’t demand constant attention, and you can learn it with just 30 minutes a day.

Tools You Actually Need

You don’t need 15 apps. You need three things:

- A reliable broker with real-time data and clean charts (think TradingView or Thinkorswim).

- A trading journal (Google Sheets works fine). Record your trades, emotions, and lessons.

- A watchlist of 5-10 stocks you understand. Don’t chase every trending stock. Know why you’re watching them. For example: NVIDIA because of AI demand, or Tesla because of production updates.

Forget about “secret indicators.” Most profitable traders use simple tools: moving averages, RSI, volume bars, and support/resistance lines. Complex systems often lead to overthinking.

The Biggest Mistakes New Traders Make

Here’s what actually kills accounts-not bad luck, but predictable errors.

- Overtrading: Trading just to feel active. If you don’t have a clear setup, don’t pull the trigger.

- Ignoring stop-losses: Holding onto losing trades hoping they’ll bounce back. That’s how small losses turn into account-destroying crashes.

- Chasing hot tips: That Reddit post or YouTube video telling you to buy a stock? It’s often a pump-and-dump. Do your own research.

- Trading without a plan: Deciding to buy because “it looks good” is not a strategy. Write your entry, exit, and risk level before you click buy.

- Emotional trading: Fear makes you sell too early. Greed makes you hold too long. Both destroy consistency.

One trader I know lost $18,000 in three months because he kept doubling down on a losing position. He thought he was “smart” for holding on. He was just stubborn.

How to Read a Stock Chart (Without the Jargon)

You don’t need to be an engineer to read charts. Here’s what matters:

- Price action: Is the stock making higher highs and higher lows? That’s an uptrend. Lower highs and lower lows? Downtrend.

- Volume: High volume on a price move means real interest. Low volume? Probably noise.

- Support and resistance: Support is where buyers step in. Resistance is where sellers take over. Watch these levels-they’re psychological anchors.

- Candlestick patterns: A long green candle after a drop? Buyers are stepping in. A long red candle after a rally? Sellers are taking control.

Look at the chart of AMD in late 2023. It bounced off $120 three times. Then it broke above $135 with heavy volume. That wasn’t luck-it was a pattern. Traders who recognized it bought on the breakout. Others waited for “confirmation” and missed the move.

How Much Money Do You Need to Start?

You can start with $500. But you won’t make much. To trade effectively, you need enough room to manage risk.

- $500-$2,000: Good for learning. You’ll be limited to one or two small trades at a time. Focus on education, not profits.

- $2,000-$10,000: Enough to trade swing strategies with proper position sizing. You can start making meaningful gains if you’re disciplined.

- $10,000+: Opens up more flexibility, better risk management, and access to margin (with caution).

Don’t wait until you have $50,000 to start. Start with what you have-but treat it like it’s the last money you’ll ever risk.

What to Avoid Like the Plague

Some things are never worth it.

- Options trading as a beginner. It’s not “leverage”-it’s a fast way to lose everything. Learn the basics of stocks first.

- Margin trading unless you’ve been profitable for over a year. Borrowing money to trade multiplies losses as fast as gains.

- Copy trading platforms where you follow someone else’s trades. You don’t learn anything. If they lose, you lose-and you won’t know why.

- Trading during earnings season if you’re new. Earnings can make stocks swing 20% in minutes. Even pros get burned.

How to Stay Consistent

Trading isn’t about being right 80% of the time. It’s about being right enough to make money over time.

Successful traders follow routines:

- Review the market before open-what’s happening overnight? What stocks are moving?

- Stick to your watchlist. Don’t chase every headline.

- Set daily profit and loss limits. Stop trading if you hit either.

- Take breaks. Burnout leads to careless trades.

- Read one book a month. Start with "Trading in the Zone" by Mark Douglas.

There’s no magic system. Just repetition, reflection, and patience.

Final Thought: This Is a Marathon

Stock trading doesn’t make you rich overnight. It makes you disciplined. It teaches you to control fear, manage risk, and think clearly under pressure. Those skills are worth more than any trade you’ll ever make.

Most people quit before they get good. If you stick with it for two years, you’ll be ahead of 90% of the people who started with you.

Can you make a living from stock trading?

Yes, but not quickly. Most full-time traders have been trading for at least 3-5 years before replacing a full-time income. They typically need a $50,000-$100,000 account to generate $3,000-$8,000 monthly returns consistently. It’s not about luck-it’s about having a proven edge, strict risk controls, and emotional stability.

Is stock trading gambling?

Only if you’re guessing. Gambling is betting on outcomes with no edge. Trading is using patterns, data, and rules to tilt the odds in your favor. A trader who checks volume, support levels, and market context isn’t gambling-they’re analyzing. The difference is preparation.

Do I need a degree to trade stocks?

No. Many top traders have no finance background. What matters is your ability to learn, adapt, and stick to a plan. You don’t need a CFA or MBA-you need a trading journal, discipline, and the willingness to lose small amounts while you learn.

What’s the best time to trade stocks?

The first hour after the market opens (9:30-10:30 AM ET) and the last hour before close (3:00-4:00 PM ET) have the most volatility and volume. That’s when most trends form and break. Midday is often flat and slow-harder to profit from. Swing traders don’t need to trade at all times-they just need to act when their setup triggers.

How do I know if I’m ready to trade real money?

You’re ready when your paper trading results show consistent profitability over at least 100 trades, with a win rate above 55% and a positive risk-reward ratio (at least 1:2). You should also be emotionally calm during losses. If you feel anxious or angry after a losing trade, keep practicing. Your psychology matters more than your strategy.

Next Steps

Start today-not tomorrow. Open a paper trading account. Pick one stock you understand. Watch its price action for a week. Write down what moves it. Then make one simulated trade. See how you feel when it wins or loses. That’s your first real step into trading.

Don’t look for the perfect system. Look for the one you can stick with. The market doesn’t care how smart you are. It only cares if you’re consistent.

deepak srinivasa

January 4, 2026 AT 15:25I've been paper trading for 4 months now and honestly, the biggest shock wasn't the losses-it was how often I ignored my own rules when the market moved fast. I thought I was ready. Turns out, I was just impatient.

pk Pk

January 6, 2026 AT 01:48Bro, this is gold. Seriously. I started with $300, followed every Reddit guru, lost it all in 3 weeks. Then I read this post, did the journal thing, and now I'm up 21% in 60 days. No magic. Just discipline. Keep going, new traders-you got this.

NIKHIL TRIPATHI

January 6, 2026 AT 21:19Swing trading really is the sweet spot for most of us with 9-to-5 jobs. I check my watchlist at 8:30 AM and 3:45 PM, that's it. Made my first $500 profit last month on a single NVDA setup. Didn't even need to stare at the screen. Just waited for the pattern. Also, the 1% rule saved me twice already. Don't skip it.

Shivani Vaidya

January 7, 2026 AT 07:58Rubina Jadhav

January 8, 2026 AT 22:04sumraa hussain

January 9, 2026 AT 22:20OH MY GOD. I just lost $800 on a meme stock because I thought ‘this time is different’… and then I read this post. Like… I’m crying. Not because I lost money. Because I finally get it. This isn’t a game. It’s a craft. Thank you.

Nalini Venugopal

January 10, 2026 AT 09:17Just wanted to say thank you for mentioning the journal. I started using Google Sheets last month and already noticed I kept buying when I was anxious. Now I pause. And I don’t trade. Changed everything. Also, avoid trading on Fridays. Too much noise.

Pramod Usdadiya

January 10, 2026 AT 09:56u/AdityaSinghBisht u right about the 1% rule. I did it wrong at first. I thought 1% was 1% of my balance… but I forgot to count my margin. Big mistake. Now I use a simple calc. No more overtrading. 🙏

Aditya Singh Bisht

January 10, 2026 AT 13:33Started paper trading 2 weeks ago. Did 15 trades. 11 winners. But I kept holding winners too long. Learned that fast. Now I set alerts. If it hits my target? I sell. No second guessing. This is the first time I feel like I’m in control. Keep it up, everyone!

Agni Saucedo Medel

January 11, 2026 AT 14:17Just started with $200. Used your tips. Paper trading for 6 weeks. Now I’m ready to go live. 🙌 So proud of myself. This post literally changed my life. Thank you 🌟

ANAND BHUSHAN

January 11, 2026 AT 19:18Indi s

January 13, 2026 AT 07:37My dad used to say, ‘If you don’t know why you’re doing something, don’t do it.’ I didn’t get it until I lost my first $1000. Now I write down every reason before I click buy. It’s weird. But it works.

Rohit Sen

January 13, 2026 AT 13:10Vimal Kumar

January 13, 2026 AT 13:36Hey, just wanted to add-don’t underestimate the power of walking away. I used to sit there for hours watching charts. Now I set a timer. 45 minutes max. Then I go make tea, stretch, call a friend. Come back fresh. My win rate jumped 30%. Your brain needs rest, not more data.