Most people want to build wealth, but few actually do. The problem isn’t that they don’t earn enough-it’s that they don’t know how to make their money work for them. You can have a great job, a solid salary, and still feel stuck. Why? Because money sitting in a savings account barely keeps up with inflation. Real growth happens when you invest wisely. And yes, that’s possible even if you’re not rich, not a finance expert, or scared of the stock market.

Start with Clear Financial Goals

You can’t invest your way to a vague dream like "being rich." You need specifics. What does success look like for you? Do you want to buy a home in five years? Retire at 55? Send your kids to college without loans? Pay off your mortgage early? Each goal needs a number and a timeline.For example:

- Save $40,000 for a down payment on a house in 3 years

- Build a $500,000 retirement fund by age 58

- Create a $20,000 emergency fund in 18 months

These aren’t just wishes-they’re targets. And targets need a plan. Without them, your money drifts. With them, every dollar has a job.

Know What Kind of Investor You Are

Not everyone should buy individual stocks. Not everyone should put everything into real estate. Your risk tolerance, time horizon, and lifestyle shape your investment style.If you’re 25 and just starting out, you can afford to take more risk. A 70/30 split between stocks and bonds might work. If you’re 55 and planning to retire in 5 years, you’ll want to protect what you’ve built. Maybe 40/60 stocks to bonds. And if you hate checking your portfolio every week? Index funds are your best friend.

Here’s the truth: most people who try to pick stocks lose money over time. A 2024 DALBAR study found that the average investor underperformed the S&P 500 by 3.5% annually over 20 years-not because the market was bad, but because they bought high and sold low out of fear or excitement.

So ask yourself: Do you want to spend hours researching companies? Or do you want to set it and forget it? The answer determines your path.

Use Low-Cost Index Funds to Build Wealth

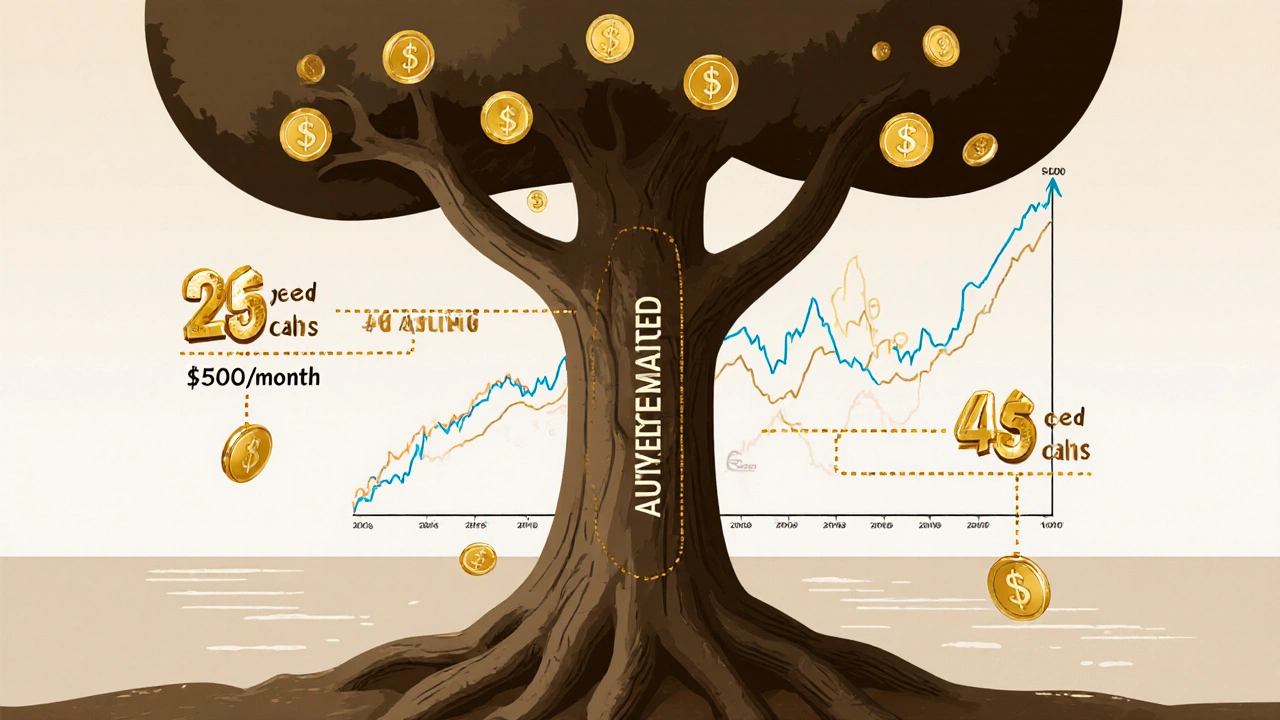

The easiest, most reliable way to grow wealth over time is through low-cost index funds. These are funds that track the entire stock market-like the S&P 500 or the total U.S. market. They don’t try to beat the market. They just become the market.Why does this matter? Because over the last 90 years, the S&P 500 has returned about 10% annually on average. That’s not magic. That’s compound growth. If you invest $500 a month starting at age 25, with a 10% annual return, you’ll have over $1.4 million by 65. Do that same $500/month starting at 35? You’ll have $570,000. The difference? Ten years. That’s the power of time.

Look for funds with expense ratios under 0.10%. Vanguard, Fidelity, and Schwab all offer these. Avoid mutual funds with sales loads or high fees. They eat your returns. A 1% fee on a $100,000 portfolio costs you $1,000 a year. That’s $25,000 over 25 years-money that could’ve grown into another home.

Automate Everything

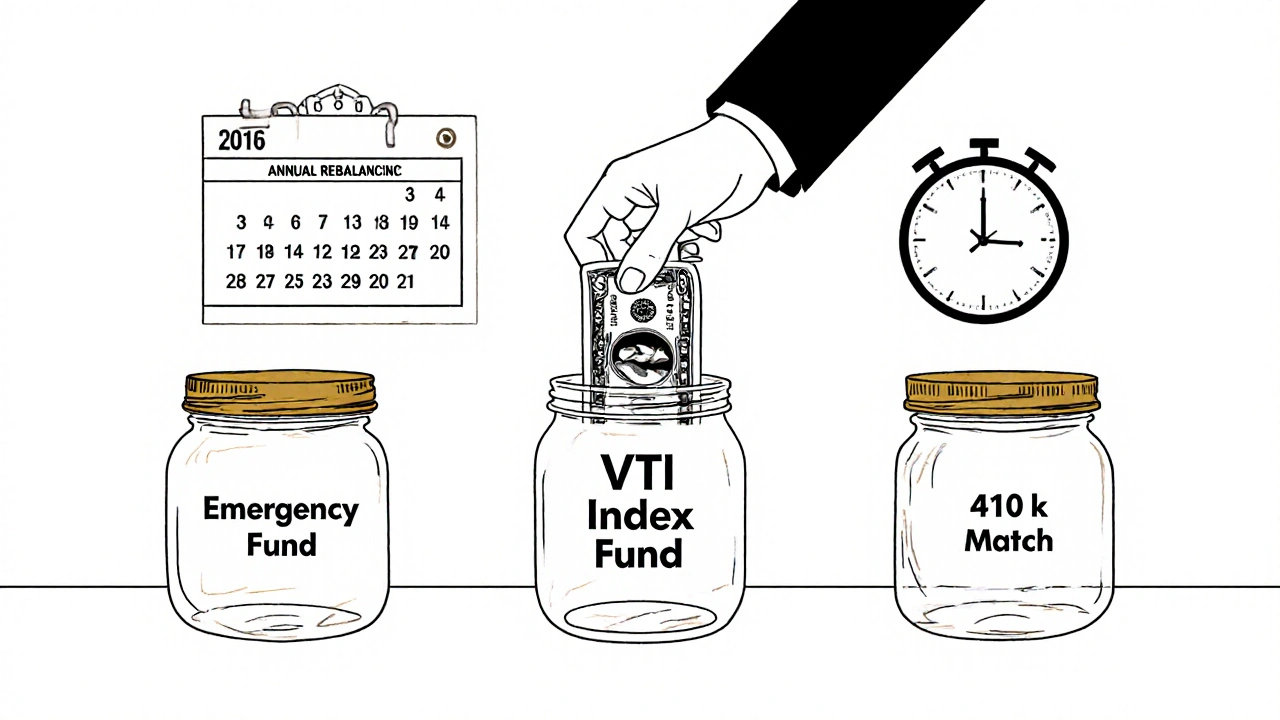

The biggest mistake people make? Waiting until they "have time" or "feel ready." You don’t need to be ready. You just need to start.Set up automatic transfers from your checking account to your investment account. Even $50 a week adds up. If your employer offers a 401(k) match, contribute at least enough to get the full match. That’s free money-5% to 6% extra on your salary, instantly.

Use apps like Betterment or Wealthfront if you want hands-off investing. Or use Fidelity or Vanguard directly if you prefer control. Either way, automate. Make investing as routine as paying your electric bill. Out of sight, out of mind. And that’s exactly what you want.

Build an Emergency Fund First

Before you invest, make sure you have cash set aside for emergencies. This isn’t optional. Life doesn’t wait for you to be ready. A car breaks down. Your fridge dies. You get laid off. If you don’t have savings, you’ll sell investments at a loss to cover it-and that kills your long-term plan.Keep three to six months’ worth of living expenses in a high-yield savings account. Right now, those accounts pay 4% to 5% interest. That’s better than inflation. And it’s liquid-meaning you can access it fast without penalties.

Don’t confuse this with your investment account. This is your safety net. Keep it separate. Treat it like a non-negotiable bill.

Avoid These Three Investment Mistakes

Most people lose money not because the market is bad-but because they make simple, avoidable errors.- Chasing hot stocks: Bitcoin, meme stocks, AI hype-they all flash bright. But most of them crash harder than they rise. If you’re buying something because it’s trending, you’re gambling.

- Timing the market: No one consistently predicts when to buy or sell. Even professionals get it wrong. Waiting for the "right time" means you miss the best days. The top 10 performing days in the S&P 500 over 20 years account for nearly half the total return. Miss those, and your returns plummet.

- Ignoring taxes: Put your investments in the right accounts. Use Roth IRAs for long-term growth (tax-free withdrawals). Use traditional IRAs or 401(k)s if you want a tax break now. Don’t hold taxable bonds in a regular brokerage account-those generate annual taxes. Use tax-efficient funds like index ETFs instead.

Rebalance Once a Year

Markets move. Stocks go up. Bonds go down. Your original 70/30 split might become 80/20 after a strong year. That’s fine-but it means you’re taking on more risk than you planned.Once a year, check your portfolio. Sell some of what’s grown too big. Buy more of what’s fallen behind. This brings you back to your target. It’s not about predicting the future. It’s about staying on course.

Most automated platforms do this for you. If you’re managing it yourself, set a calendar reminder. Don’t overthink it. Just adjust.

Keep Learning-But Don’t Overcomplicate

You don’t need to read 10 finance books. You don’t need to follow 20 financial influencers. Just stick to the basics: save early, invest consistently, keep costs low, avoid panic.Read one book: The Simple Path to Wealth by JL Collins. It’s clear, no fluff, written by a former engineer who retired early. Watch one video: Vanguard’s "Why Index Funds Win" on YouTube. That’s enough.

Investing isn’t about being smart. It’s about being steady.

What Comes Next?

Start today. Even if it’s just $25. Open an account at Vanguard or Fidelity. Set up an automatic transfer. Pick one index fund-like VTI (Vanguard Total Stock Market ETF) or SPY (SPDR S&P 500 ETF). And leave it alone.Don’t wait for the perfect moment. There isn’t one. The best time to start was 10 years ago. The second-best time is now.

How much money do I need to start investing?

You can start with as little as $1. Many brokers like Fidelity, Charles Schwab, and Robinhood allow fractional shares, so you can buy a portion of a stock or ETF. The key isn’t how much you start with-it’s that you start consistently. Even $25 a week adds up over time.

Should I invest in real estate or stocks?

Both can work, but stocks are easier for most people. Real estate requires more money upfront, more hands-on work, and carries higher risks like vacancies or bad tenants. Index funds give you instant diversification across hundreds of companies. If you want real estate, consider REITs (Real Estate Investment Trusts) held inside your brokerage account. They act like stocks but track property markets.

Is it too late to start investing if I’m over 40?

No, it’s never too late. If you’re 45 and start investing $800 a month with a 7% return, you could still build over $500,000 by 65. The key is to invest more aggressively than you would have at 25. Max out your 401(k) and IRA. Cut unnecessary expenses. Focus on growth funds. Time is shorter, but discipline still works.

What’s the safest investment for beginners?

The safest option for beginners is a low-cost total stock market index fund like VTI or FSKAX. These funds hold thousands of companies across all sectors and sizes. They’re diversified, low-cost, and historically have delivered strong returns over the long term. For even lower risk, pair it with a bond fund like VBTLX. But remember: safety doesn’t mean zero risk. It means reducing the chance of permanent loss through diversification and time.

How do I know if I’m on track to meet my goals?

Use a simple rule: multiply your annual savings by 20. That’s roughly how much you’ll need to retire comfortably. If your goal is $500,000, you need to save $25,000 a year. If you’re saving $15,000, you’re 60% there. Track your progress every six months. Adjust your savings rate or investment return expectations if you’re behind. Small changes now make big differences later.

Final Thought: Wealth Is a Habit, Not a Windfall

You won’t get rich overnight. You won’t win the lottery. You won’t find a secret app that turns $100 into $10,000. Real wealth is built slowly-through consistent action, smart choices, and patience. It’s showing up every month, even when the market drops. It’s choosing discipline over excitement. It’s knowing that your future self is counting on you today.Start small. Stay steady. Let time do the heavy lifting.

Bharat Patel

November 16, 2025 AT 09:16It’s funny how we think wealth is about earning more, when really it’s about not wasting what we already have. I used to keep cash under my mattress-literally-because I was scared of the stock market. Then I read JL Collins and realized I was just afraid of the unknown. Now I invest $100 a month in VTI and sleep better than ever. Time doesn’t care how much you start with. It only cares that you show up.

Bhagyashri Zokarkar

November 17, 2025 AT 17:43i just started with 50 bucks a week and honestly its like magic like i dont even think about it anymore my phone just takes it out and its gone and boom 6 months later i have 1200 and i didnt even feel it like its not about being rich its about being consistent and not checking it every day like my grandma used to say money grows in silence

Rakesh Dorwal

November 19, 2025 AT 12:12Index funds? Sure. But who really owns those funds? Big banks. Wall Street. The same people who crashed the economy in 2008 and got bailed out. You think you’re playing the game? You’re just another pawn. Real wealth is in land, gold, and cash in hand-not some digital ticker that can be erased with a click. And don’t get me started on ETFs-they’re just digital gambling with a fancy name. The system wants you distracted while they print more money. Wake up.

Vishal Gaur

November 21, 2025 AT 03:14so i read this whole thing and honestly i think its great but like i dont know where to start like i have a 401k but its like 3000 and i dont even know what its in and i keep seeing these apps that say invest 5 bucks a day but then they take 1 percent fee and i think wait is that even worth it and then i get overwhelmed and just close the tab and watch netflix instead i think the problem isnt the advice its the doing part

Nikhil Gavhane

November 22, 2025 AT 09:48This is one of the clearest pieces of financial advice I’ve read in years. I especially loved the part about automation-making it invisible. I used to think I needed to be an expert before I started. Turns out, I just needed to start. My first $25 transfer felt silly, but now it’s automatic. I don’t celebrate the gains, I just keep showing up. That’s the real win.

Rajat Patil

November 23, 2025 AT 05:27Thank you for sharing this thoughtful and practical guide. Many people overlook the importance of emotional discipline in investing. The market will always move. The only thing we control is our behavior. Consistency, simplicity, and patience are not glamorous, but they are the foundation of lasting wealth. I encourage everyone to begin with one small step.

deepak srinivasa

November 24, 2025 AT 23:24What if you live in a country where index funds aren’t easily accessible? I’m in India and most brokers charge high fees or have minimums I can’t meet. Are there alternatives that still follow the same principles? Or is it just impossible for people outside the US to benefit from this?

pk Pk

November 26, 2025 AT 13:17Deepak, you’re not alone. I’m from India too. You can invest in Indian index funds like Nifty 50 through platforms like Groww or Zerodha-they have low fees and fractional shares. Start with ₹500 a month. Same principle, different market. The rules don’t change: save early, invest consistently, ignore noise. You don’t need Wall Street to build wealth-you just need discipline. And you’ve got that.

NIKHIL TRIPATHI

November 27, 2025 AT 16:22Love how this breaks it down without fluff. I used to think I needed to pick the next Tesla. Turns out I just needed to buy the whole road. My 25-year-old self would’ve laughed at me for buying an index fund. My 35-year-old self is thanking him every month. Automation is the real MVP. Set it, forget it, and let compound interest do the heavy lifting.

Shivani Vaidya

November 29, 2025 AT 15:40For those concerned about accessibility in emerging markets, I recommend exploring local exchange-traded funds (ETFs) that track national indices. In India, Nifty 50 and Sensex ETFs are widely available through regulated brokers. Additionally, systematic investment plans (SIPs) allow for monthly contributions as low as ₹500. The core principles remain unchanged: diversification, low cost, and long-term consistency. Financial inclusion is possible, even without access to U.S. markets.