Most people who walk into stock trading think it’s about picking the next big stock. They watch TikTok clips of people turning $500 into $5,000 in a week and think, That’s me. But here’s the truth: 80% of retail traders lose money over time. Not because they’re dumb. Not because they don’t work hard. But because they’re playing the wrong game.

Winning Isn’t About Timing the Market - It’s About Managing Your Behavior

The biggest mistake traders make is treating the market like a slot machine. You buy a stock because it went up yesterday. You sell because it dipped 3% this morning. You chase headlines. You panic when the news says "recession risk."

Real winners don’t predict the future. They prepare for every possible version of it.

Think of it like driving in a snowstorm. You don’t try to guess where the next patch of ice is. You slow down, keep your hands on the wheel, and leave extra space. Trading works the same way. Your job isn’t to be right every time. It’s to survive long enough to let your edge play out.

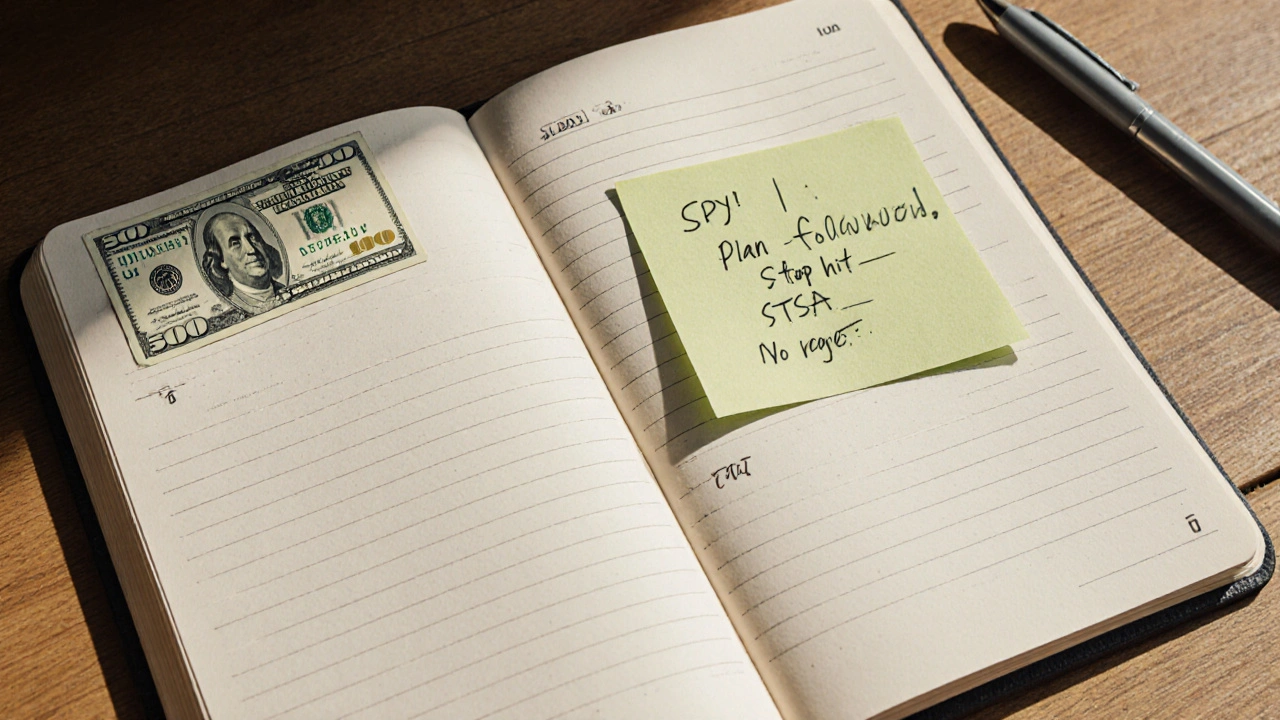

Start With a Trading Plan - Not a Dream

If you don’t have a written plan, you’re gambling. A trading plan isn’t a vision board. It’s a rulebook. Here’s what every serious trader’s plan includes:

- What you trade - Only focus on 3-5 stocks or ETFs. Don’t jump between crypto, penny stocks, and tech giants. Pick your lane.

- When you enter - Define clear triggers. Example: "Buy if stock closes above 20-day moving average with volume 20% above average."

- When you exit - Set your stop-loss before you buy. Always. No exceptions.

- How much you risk - Never risk more than 1% of your account on a single trade. If you have $10,000, that’s $100 max loss per trade.

- How often you trade - Some traders make 20 trades a week. Others make 2 a month. Both can win. Pick your rhythm and stick to it.

Write this down. Print it. Tape it to your monitor. Read it before every trade. If your emotion says one thing and your plan says another - follow the plan. Always.

Risk Management Is Your Secret Weapon

You don’t need to be right 70% of the time to win. You just need to make more on your winners than you lose on your losers.

Here’s a simple formula that works for most profitable traders:

Reward-to-Risk Ratio = 2:1 or higher

Example: You buy a stock at $50. You set your stop-loss at $47 (risk = $3). You set your target at $56 (reward = $7). That’s a 2.3:1 ratio. Even if you’re right only 40% of the time, you still come out ahead.

Most beginners do the opposite. They let losses run and take profits too early. They’re scared of missing out on more gains - so they hold past their target. Then the stock reverses, and they lose everything they gained - plus more.

Winners know when to walk away. They don’t chase. They don’t hope. They execute.

Market Psychology Beats Technical Indicators

Every chart pattern, every indicator, every moving average - they’re all just reflections of what people are doing. The real edge comes from understanding the crowd.

When everyone is excited about a stock, it’s usually near a top. When everyone is scared, it’s often near a bottom. You don’t need to be smarter than the crowd. You just need to be calmer.

Watch volume spikes. Watch how price reacts to news. If a stock jumps 10% on a headline but volume is low, it’s probably a fake breakout. If it drops 5% on no news but volume is 3x normal, that’s smart money leaving.

Use tools like the VIX (the "fear index") to gauge overall market emotion. When VIX is below 15, markets are complacent - be careful. When it’s above 30, panic is high - that’s when opportunities hide.

Track Everything - Even the Small Stuff

Winners keep detailed journals. Not just "Bought AAPL at $175, sold at $180." That’s useless.

They write:

- Why I took the trade (reference to my plan)

- How I felt before, during, and after

- What distracted me

- What I learned

After 20 trades, patterns emerge. Maybe you notice you always lose money on trades you take after 3 p.m. Maybe you see that you overtrade when you’re tired. Maybe you realize you ignore your stop-loss when you’re feeling "lucky."

Journaling turns experience into wisdom. Without it, you’re just spinning your wheels.

Stop Chasing the Holy Grail

There is no secret indicator. No magic bot. No guru who knows the future. The "holy grail" of trading is a myth sold by people trying to sell you a course.

What actually works? Simple things done consistently:

- Stick to your plan

- Manage your risk

- Control your emotions

- Learn from every trade

One trader I know made $187,000 in 14 months trading only three stocks: SPY, QQQ, and TSLA. He didn’t use fancy tools. He didn’t trade every day. He just followed his plan - and never broke his 1% risk rule.

He didn’t win because he was brilliant. He won because he didn’t lose.

Start Small. Stay Patient.

You don’t need to trade full-time. You don’t need to quit your job. You don’t need $50,000 to start.

Start with $500. Trade one stock. Focus on learning. Track your journal. Stick to your plan. After six months, you’ll be better than 90% of the people who started with $10,000 and thought they knew it all.

The market doesn’t reward speed. It rewards discipline.

Winning in the stock trading arena isn’t about flashy wins. It’s about showing up every day, doing the boring work, and refusing to let emotion drive your decisions. That’s how the real winners build wealth - slowly, steadily, and without drama.

Can you really make money trading stocks without being a financial expert?

Yes - but not by guessing or following influencers. You don’t need an MBA or a finance degree. You need a clear plan, discipline, and the ability to control your emotions. Most successful retail traders are regular people who treat trading like a skill to be practiced, not a lottery to be won.

How much money do I need to start trading stocks?

You can start with as little as $100 on platforms like Robinhood or Webull. But to trade effectively and manage risk, aim for at least $500-$1,000. This gives you enough room to diversify slightly and follow the 1% risk rule without getting wiped out by a single bad trade.

Is day trading better than long-term investing?

It depends on your personality and goals. Day trading requires constant attention, quick decisions, and high emotional control. Long-term investing works for people who want to build wealth over years with minimal effort. Most people are better off starting with long-term investing. Day trading has a much higher failure rate - especially for beginners.

What’s the biggest mistake new traders make?

They risk too much on one trade. Many start with $1,000 and bet $500 on a single stock. One loss wipes out half their account. Then they try to double down to recover - and lose everything. The fix? Never risk more than 1% of your account on any single trade.

Should I use leverage or margin in trading?

Avoid it - especially as a beginner. Leverage multiplies both gains and losses. A 2x leveraged trade that moves 5% against you wipes out 10% of your account. Most professional traders avoid leverage for this reason. If you’re still learning, treat margin like a chainsaw - dangerous even when you know how to use it.

How long does it take to become a profitable trader?

Most traders take 6 to 18 months to become consistently profitable. It’s not about how much you learn - it’s about how many trades you do while staying disciplined. Some people take longer because they skip journaling or ignore their emotional patterns. The fastest learners are the ones who treat every trade like a lesson, not a win or loss.

If you’re serious about winning in the stock trading arena, stop looking for shortcuts. Start building systems. Track your progress. Learn from every mistake. The market doesn’t care how smart you are. It only cares how consistent you are.